In October 2024, foreclosure filings in the U.S. rose by 4% from the previous month, totaling 30,784 properties, according to data from ATTOM reported by HousingWire. States like Nevada, New Jersey, and Florida recorded the highest rates, reflecting the ongoing financial strain faced by many homeowners amid fluctuating mortgage rates and economic uncertainties. These numbers highlight the persistent challenges the mortgage industry faces in managing distressed loans and helping borrowers avoid foreclosure.

Traditionally, mortgage loss mitigation—a process that includes loan modifications, forbearance, and other alternatives to foreclosure—has been complex, time-consuming, and often inconsistent. For lenders, the process can be resource-intensive, while borrowers may experience frustration due to delays and a lack of personalized support.

However, with the advent of AI and automation, the dynamics of this critical process are changing. Mortgage servicers can now streamline workflows, reduce operational inefficiencies, and make faster, more accurate decisions.

AI and automation in mortgage loss mitigation process enable lenders to offer quicker, more tailored solutions for borrowers in financial distress, ultimately benefiting both parties.

What is Mortgage Loss Mitigation?

Mortgage loss mitigation refers to the procedures and strategies lenders use to assist borrowers who are struggling to keep up with their mortgage payments. The main goal of loss mitigation is to prevent foreclosure, a process that can be costly and detrimental to both the borrower and the lender. Some of the most common strategies employed in loss mitigation include:

- Loan Modification: Changing the terms of a loan, such as lowering the interest rate or extending the repayment period.

- Forbearance: Temporarily reducing or pausing payments for borrowers in financial hardship.

- Short Sale or Deed-in-Lieu of Foreclosure: Allowing borrowers to sell their home for less than the mortgage balance or voluntarily transfer the property to the lender.

The loss mitigation process is time-consuming, relying on manual paperwork, frequent follow-ups, and complex decision-making. AI-driven automation streamlines and accelerates this process, creating efficiencies and delivering benefits for all parties involved.

The Role of AI and Automation in Loss Mitigation in the Mortgage Industry

AI and automation technologies are revolutionizing various sectors, and the mortgage industry is no exception. AI automation loss mitigation is increasingly being adopted to improve the efficiency of the entire loss mitigation process. Here’s how these technologies are making a difference:

1. Faster Data Processing and Decision-Making

Mortgage servicers often need to evaluate a borrower’s payment history, income, credit scores, and other financial factors to determine the most suitable mitigation strategy. AI can process large volumes of data quickly and accurately in real-time, identifying patterns that humans may miss and recommending the most appropriate solution for each case.

AI algorithms can also predict a borrower’s likelihood of defaulting, helping servicers take proactive steps before the situation becomes dire. Leveraging predictive analytics in mortgage, insights are available almost instantaneously, drastically reducing the time needed to make decisions and offer solutions, ultimately speeding up the entire process.

2. Automated Document Collection and Verification

Mortgage document processing can be a time-consuming and error-prone task, especially when managing numerous loss mitigation cases. Traditional methods of collecting and verifying borrower documentation—such as proof of income, hardship letters, and tax returns—require significant manual effort. However, mortgage document automation streamlines this process. Automation allows lenders to collect necessary documents, verify their authenticity, and extract relevant data without human intervention. The system can flag missing documents, cross-check entries, and auto-populate fields within the lender’s platform, ensuring accuracy and minimizing delays. This reduces the manual workload, accelerates the mortgage loss mitigation process, and improves response times to borrower needs.

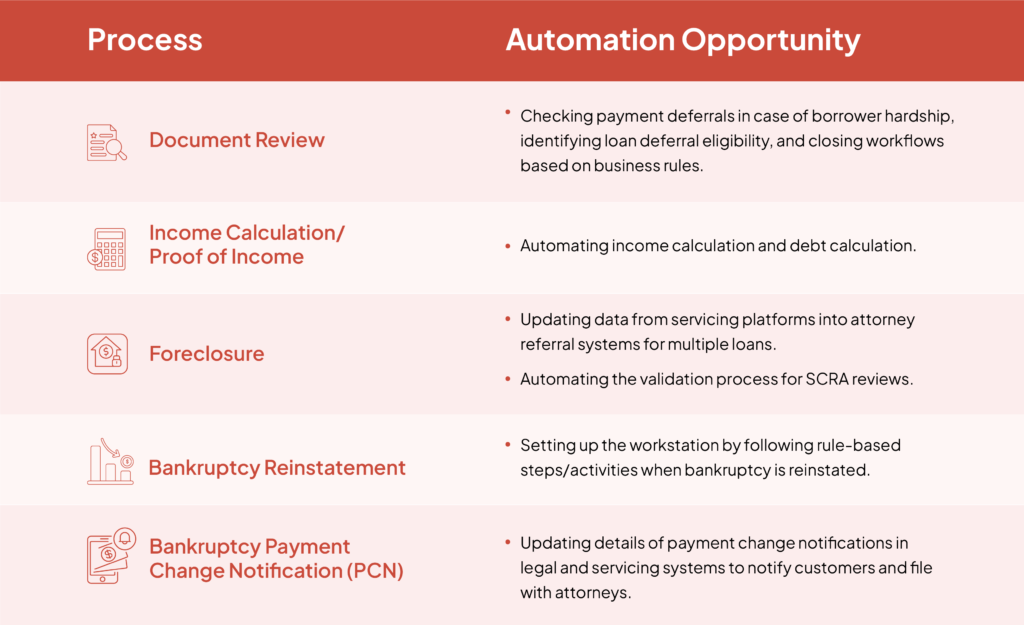

Robotic Process Automation (RPA) plays a key role in mortgage process automation by handling repetitive tasks such as document routing, data entry, and compliance checks. RPA can work alongside AI to automate document review and processing, ensuring that workflows remain efficient, accurate, and fully compliant.

3. Personalized Borrower Support

Each borrower’s financial situation is unique, and a one-size-fits-all solution rarely provides the best outcome. Traditional loss mitigation solutions often lack the flexibility needed to address individual borrower circumstances. With AI automation loss mitigation, lenders can offer personalized options that are tailored to the borrower’s specific financial condition.

AI tools can analyze a borrower’s financial data to suggest the most appropriate loss mitigation strategies. For instance, if a borrower’s income has temporarily dropped due to a health issue, AI could recommend a forbearance plan until they are able to resume full payments. Additionally, AI-powered chatbots can guide borrowers through the process, offering personalized advice, answering questions, and helping them gather the necessary documentation.

This level of personalization not only improves borrower satisfaction but also increases the likelihood of successful mitigation. When borrowers feel that the solutions offered are tailored to their needs, they are more likely to engage positively with the process.

4. Improved Compliance and Risk Management

The mortgage industry is heavily regulated, with strict guidelines outlining how lenders must handle loss mitigation cases. Non-compliance with these regulations can lead to significant fines, legal action, and damage to a lender’s reputation. AI-powered automation in loss mitigation helps lenders stay compliant by ensuring that every step of the process is properly documented and aligns with regulatory requirements.

AI in mortgage lending can seamlessly track each stage of the mitigation process, ensuring that all necessary actions are taken and that borrowers are treated equitably. Beyond tracking, AI also enhances security by detecting potential risks, such as fraudulent activities, by identifying patterns and discrepancies in borrower data. By reducing the risk of human error, AI-driven loss mitigation empowers mortgage servicers to maintain higher levels of compliance, significantly lowering the chances of costly legal and financial repercussions.

5. Proactive Intervention through Predictive Analytics

Mortgage lenders can gain substantial benefits by using data to predict financial distress before it occurs. Predictive analytics, powered by AI, can analyze a borrower’s payment history, spending patterns, and other financial behaviors to forecast when they may be at risk of missing a payment.

This early detection enables servicers to take proactive measures, reaching out to at-risk borrowers before they fall behind on their payments. For example, if AI detects that a borrower is struggling to make timely payments due to temporary financial hardship, servicers can offer forbearance or a loan modification option earlier in the process. Proactive intervention can prevent defaults and help both lenders and borrowers avoid the stress and cost of foreclosure.

The Future of Mortgage Loss Mitigation

AI-powered mortgage loss mitigation is bringing faster, more efficient, and more personalized solutions to borrowers in financial distress. The combination of AI’s ability to process large volumes of data quickly, automate routine tasks, and offer tailored solutions is transforming the way loss mitigation is handled.

As mortgage servicers adopt AI-driven tools, they can provide quicker responses, ensure better compliance, and offer more personalized assistance, all while reducing operational costs. For borrowers, this translates into a smoother, more transparent process that increases the likelihood of successfully navigating their financial difficulties.

We help mortgage lenders transform with digital mortgage solutions powered by AI and automation. Our approach streamlines every stage—from pre-qualification to closing—delivering seamless, customer-centric experiences that boost efficiency and satisfaction. By automating key tasks like document collection, data validation, and underwriting, we reduce manual errors and speed up processing while ensuring regulatory compliance. Our solutions enable faster approvals, increased transparency, and a smoother journey for borrowers, enhancing operational efficiency and reducing costs. Get in touch to explore how we can help you stand out with a modern, digital mortgage experience that drives growth and loyalty.

Modernize Mortgage Experiences NOW!

About The Author

Ayushi Sharma, Associate Marketing Manager at AppsTek Corp, drives integrated marketing strategy, brand positioning, and multi-channel execution across AppsTek’s technology and Oracle-focused service and solution lines. With experience spanning technology, SaaS, consulting, and digital-first brands, Ayushi brings a broad industry perspective to building structured marketing programs, clarifying narratives, and enabling teams to operate with focus and impact. Her approach emphasizes strategy, alignment, and creating marketing systems that elevate both brand and revenue outcomes.