The rise of real-time digital mortgage solutions has significantly impacted consumer expectations. Nowadays, people expect prompt and efficient services, such as same-day deliveries and instant flight bookings accompanied by notifications. These offerings have become synonymous with efficiency and convenience in modern consumer behavior.

In fact, according to a study by Capgemini, a staggering 76% of customers worldwide expect an omnichannel lending experience, while about 59% prefer on-demand, anytime customer service. It is no longer about the convenience of using mobile applications and has expanded to crafting seamless environments that enable customers to effortlessly transition between channels.

Failing to meet these expectations carries substantial consequences, as research indicates that 54% of consumers are willing to switch to other brands or businesses in search of better customer service. In this light, the arrival of a cross-channel digital mortgage platform stands out as a notable change, primed to reshape the mortgage lending journey for both lenders and borrowers alike.

These changes mark a significant shift in the financial sector, transitioning from conventional practices to a fresh approach centered on transparency and prioritizing digital interactions—whether online, through mobile apps, or in person.

Bridging the gap between digital and physical realms to ensure a seamless customer experience across all channels presents a pivotal challenge. However, omnichannel lending rises to the occasion, breaking free from tradition to provide customers with a cohesive and integrated journey.

So, what is Omnichannel Lending, and how does it differ from Multichannel Lending?

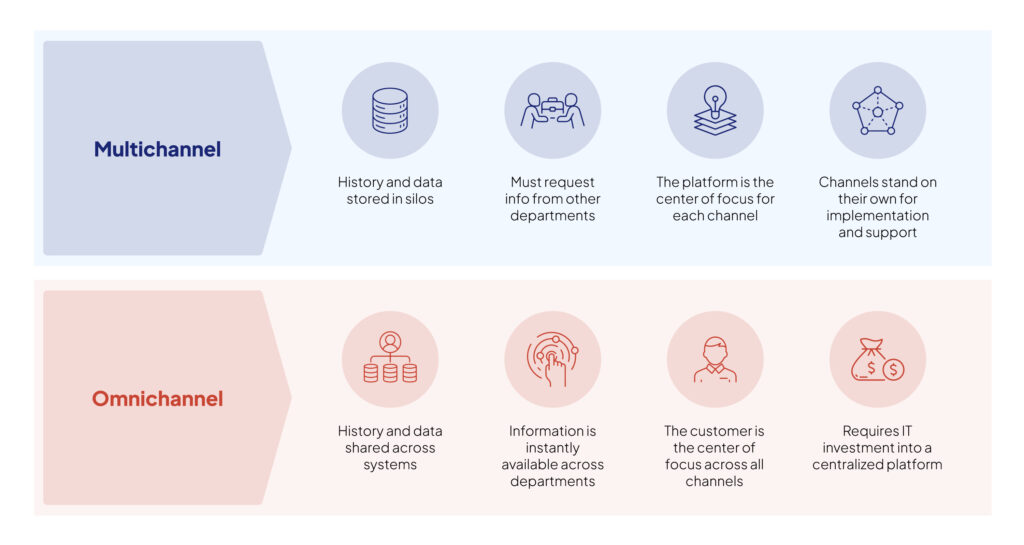

Though the term “omnichannel” is often used interchangeably with the term “multichannel,” it is important to note that they are different concepts that describe approaches to customer engagement.

Multichannel lending encompasses diverse customer interactions across numerous touchpoints and platforms, spanning physical branches, websites, mobile apps, social media platforms, call centers, and beyond. Despite the broad spectrum of engagement opportunities, each channel typically functions autonomously, operating on disparate systems and processes and offering its own services. The proliferation of channels provides customers with a wealth of options, yet the lack of integration often results in inconsistencies across touchpoints, leading to a fragmented customer experience.

The concept of omnichannel lending is rooted in the Latin word ‘omni,’ meaning ‘everywhere’ or ‘in all ways,’ illustrating that lenders can provide their services through a variety of channels, ensuring a seamless customer experience regardless of the interaction point. However, it goes a step further by adopting a unified approach.

The essence of omnichannel lending lies in seamlessly integrating all channels to create a harmonious customer experience. Through this strategy, customers can initiate interactions—transactions or support requests—via one channel and effortlessly transition to another, ensuring a seamless journey that meets their expectations for consistency and continuity.

Omnichannel lending redefines the customer experience, leveraging insights from multiple channels to offer personalized recommendations, targeted offers, and communication. The approach not only meets customers’ digital expectations but also adds a distinctive touch, enabling mortgage enterprises to surpass expectations. These solutions empower enterprises to foster stronger customer relationships, driving satisfaction and long-term loyalty.

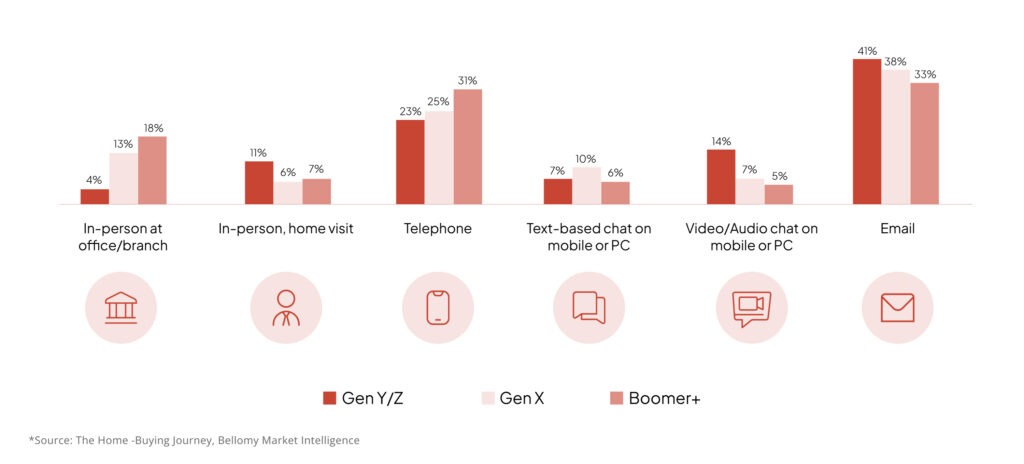

The image presented below illustrates the preferred communication channels used during the mortgage process, categorized by different customer age groups.

Best Practices for Omnichannel Lending Implementation

Adopting an omnichannel mortgage strategy transcends mere tool adoption; it demands a holistic business transformation with a customer-centric focus. Such a shift poses both technical and organizational hurdles. Hence, the question arises – where does the implementation journey start?

First, achieving seamless functionality across all channels necessitates centralized access to data. Consistency in financial, personal, and marketing information across branches, web, mobile, telephone, and other platforms is imperative, ensuring customers can effortlessly resume their interactions regardless of their preferred channel.

Secondly, effectively training employees to communicate across multiple channels is paramount in implementing such a strategy. It goes beyond mastering new tools; it often involves restructuring customer service processes and potentially realigning organizational departments.

An invaluable advantage of implementing an omnichannel strategy lies in the capability to analyze customer transaction data from diverse channels, systems, and social networks.

Leveraging Big Data technology facilitates collecting and analyzing information to craft detailed customer profiles and comprehend their behavior. Rich customer data enables more precise risk assessment, personalized communication, and targeted offer deployment, optimizing profitability in sales channels and driving higher revenue.

Adopting an API-driven architecture is key to seamlessly integrating various channels, including mobile apps, websites, etc. APIs facilitate data and functionality exchange between disparate systems, enabling customers to seamlessly access mortgage services across multiple channels. Such an approach enables mortgage enterprises to swiftly adapt to evolving customer needs and market dynamics.

Use Cases of Omnichannel Lending

Omnichannel lending unlocks numerous practical applications, harnessing its integrated approach to elevate customer experiences, streamline operations, and fuel business expansion. Explore the pivotal applications of omnichannel lending below:

- Customer Onboarding: Experience seamless customer onboarding as individuals initiate account openings through diverse channels like mobile apps, websites, or in-person visits. Synchronizing customer data across platforms via a unified system eliminates redundant entries, ensuring a cohesive onboarding journey irrespective of the chosen channel.

- Integrated Customer Support: Facilitate seamless customer support across multiple communication channels—phone, email, live chat, and social media. Customers encountering transactional hiccups can effortlessly switch channels while maintaining continuity. Armed with a holistic view of customer interactions, support agents deliver efficient, personalized assistance.

- Cross-Channel Transactional Flexibility:Empower customers to initiate and conclude transactions seamlessly across channels. For example, commence a mortgage application on a mobile app, proceed on the website, and finalize the process at a physical branch. This capability enhances convenience while ensuring transactional consistency and accuracy.

- Predictive Customer Data Analytics for Risk Management: Leverage advanced analytics and predictive modeling to preemptively address risks like fraud, credit defaults, and compliance breaches. Real-time customer data analysis across channels enables proactive intervention, preventing fraudulent activities and mitigating potential losses.

- Enhanced Digital Self-Service Options: Provide customers with comprehensive digital self-service avenues—self-service kiosks, interactive voice response (IVR) systems, and chatbots. Execute various transactions effortlessly, from account inquiries to fund transfers, reducing reliance on human intervention and bolstering operational efficiency.

- Robust Data Analysis: Employ omnichannel lending solutions for robust data collection and analysis. By amalgamating data from diverse sources, lenders construct a holistic customer view, paving the way for predictive service delivery. Additionally, built-in analytics tools aid in monitoring customer behavior, identifying opportunities, and adapting swiftly to market dynamics.

- Real-time Engagement: Foster real-time engagement by leveraging omnichannel data insights. Through personalized notifications, instant messaging, and interactive chatbots, promptly address inquiries, resolve issues, and offer customized recommendations. The engagement caters to the expectations of digitally savvy customers, ensuring a seamless experience.

Incorporating omnichannel lending promises both efficiency and a heightened level of customer satisfaction and engagement.

Benefits of Omnichannel Lending for Customers

- Increased Efficiency: Omnichannel lending increases efficiency for digital mortgage lenders by streamlining operations, integrating channels and systems, and reducing waste. This leads to more efficient resource utilization and cost savings. For example, a customer initiating a transaction via a mobile device can complete it without a loan officer, freeing up their time for other tasks.

- Cost Savings: Omnichannel lending can save mortgage enterprises money by consolidating systems and offering self-service options to customers via digital channels, reducing the need for duplicate resources, strategies, and expensive branch operations.

- The Ability to Offer Personalized Services: Omnichannel lending allows lenders to offer personalized services to customers based on their needs and preferences. By gathering data on customers’ interactions with different channels, lenders can provide more targeted and relevant services, such as delivering personalized offers to customers who use mobile devices.

Benefits of Omnichannel Lending for Mortgage Enterprises

- Convenience: Omnichannel lending offers convenient access to digital mortgage services through various channels, including mobile apps, web, and physical branches. It saves time and provides a better customer experience.

- Flexibility: Omnichannel lending lets customers choose the digital mortgage channel that fits their needs, preferences, and lifestyle. They can apply through mobile, web, or visiting the branch in person for complex transactions.

- Accessibility: Omnichannel mortgages also provide customers with greater accessibility to mortgage services. Customers can access mortgage services from anywhere, regardless of their location. This is particularly beneficial for customers who live in remote areas or have limited access to physical branches.

- Personalized Services: Omnichannel mortgages use data analytics to offer personalized services and tailored products to meet customer needs. To increase customer loyalty, lenders use customer data to provide customized offers, promotions, and rewards.

Conclusion

To meet the expectations of millennials and digitally adept customers, lenders need to integrate diverse channels for a seamless omnichannel mortgage journey. To stay competitive and foster growth, they must prioritize addressing customers’ lending needs in alignment with their preferences and embrace tools for seamless interactions, synchronize digital and physical touchpoints, harness customer data, and revamp internal processes within an omnichannel mortgage framework.

To know more about omnichannel lending solutions for your mortgage enterprise, get in touch with us today!

Modernize Mortgage Experiences NOW!