Accelerating the mortgage loan application and approval procedure for prospective homeowners is a paramount concern for established institutions as they strive to maintain their market share amid competition from nonbanks and emerging alternative lending startups.

Consequently, the majority of mortgage institutions are spearheading a revolution in the conventional underwriting process by embracing automated underwriting systems. These systems have ushered in a more streamlined, secure, and highly efficient mortgage approval process, ultimately fostering a lending environment that is both responsive and competitive.

In this blog, we’ll explore the ins and outs of automated mortgage underwriting, its technologies, significance, benefits, and its role in simplifying the underwriter’s tasks for lenders.

Automated Mortgage Underwriting – An Overview

Automated mortgage underwriting is a technology-driven process used to evaluate borrowers’ qualifications for loans. It speeds up loan approval, ensures accuracy, and increases efficiency.

Automated mortgage underwriting systems are the software and technology platforms that enable this process. Various technologies are used to analyze borrower information, credit reports, financial data, and other relevant factors to make informed lending decisions.

The Technology Behind Automated Mortgage Underwriting Systems

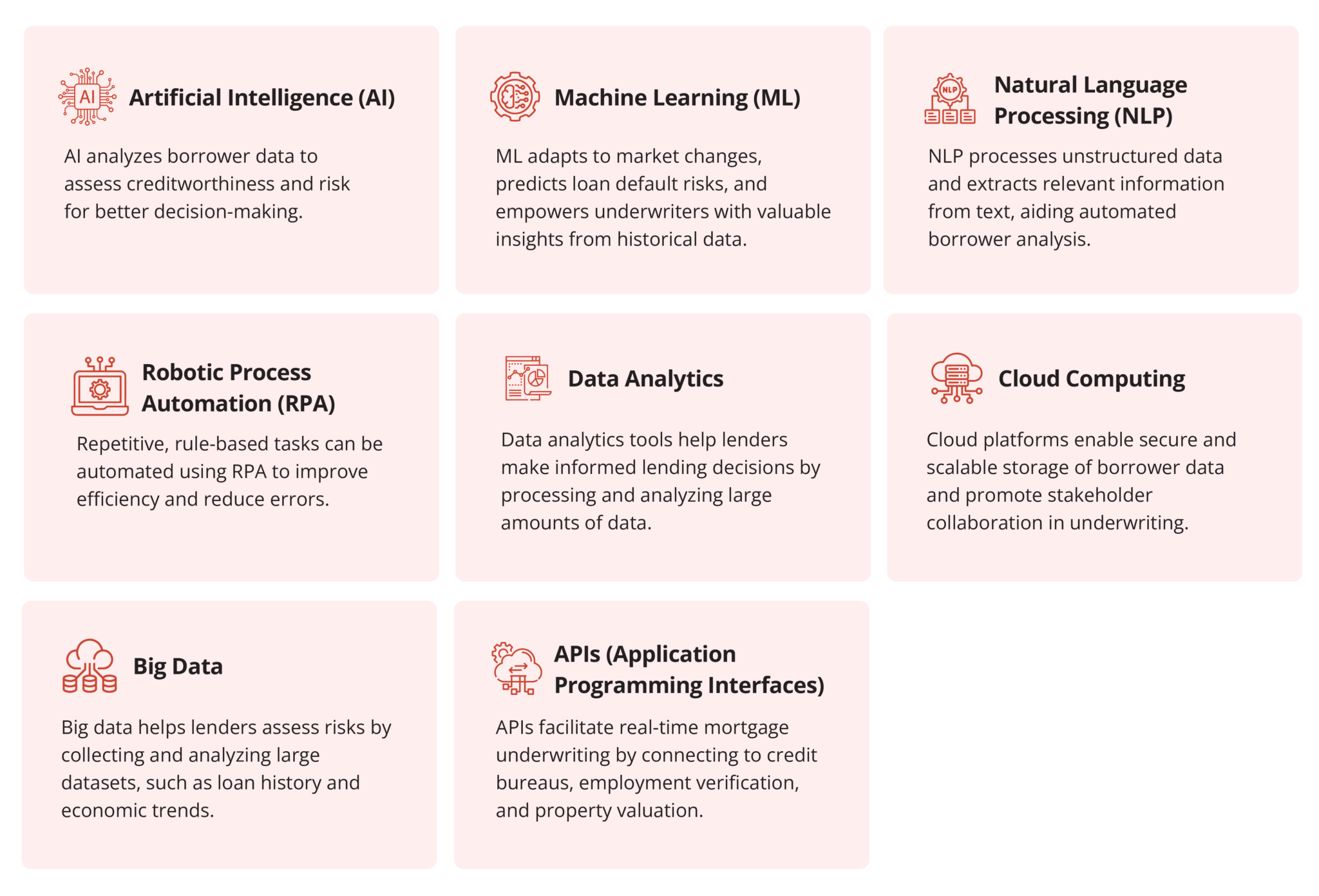

Key technologies used in automated mortgage underwriting systems include:

Automated mortgage underwriting systems utilize technology to expedite approvals, reduce manual labor, improve accuracy, and facilitate faster decision-making, all while ensuring regulatory compliance.

Importance of Automated Mortgage Underwriting Across Various Lending Stages

1. Mortgage Loan Application

Mortgage underwriters must scrutinize borrower employment details to assess their loan repayment capacity, and this task has become increasingly challenging post-pandemic due to the heightened volatility in borrower employment statuses. Approving loans for unemployed borrowers became a risk beyond the control of the underwriter.

Automated mortgage underwriting employs AI-powered models to continuously monitor and analyze borrowers’ transaction data in real time. These models can detect sudden changes in borrowers’ transaction patterns, which may indicate a positive or negative change in their financial status. After analyzing the borrower’s risk of default, the automated underwriting system suggests that lenders provide customized solutions to high-risk borrowers.

2. Loan Processing Documentation

The mortgage lending process encompasses numerous systems, databases, and workflow tools, leading to the creation of substantial document volumes crucial for processing loan applications. Underwriters must manually access each platform to retrieve documents, causing significant delays in lending.

Automated underwriting systems gather documents from various sources and store them digitally in a centralized repository. They also employ specific naming conventions, such as applicant and property name, to categorize and label customer data, enabling underwriters to retrieve and access specific information effortlessly.

3. Borrower Risk Assessment

Manual underwriting, as a process, is often inefficient due to siloed data sources. Without a centralized reserve for gathering, segmenting, storing, and accessing data, underwriters run the risk of missing out on crucial information that is likely to impact a borrower’s risk profile.

Automated mortgage underwriting systems come equipped with reporting and visualization tools capable of breaking data silos, streamlining processes, and gathering data that can be viewed and accessed on a centralized dashboard.

These tools can sort and group data based on types, like tax forms and income details, while automated risk rating features, based on loss-given default and probability of default models, capture key risk metrics for proper borrower risk assessment.

4. Borrower Credit Assessment

Manual underwriters must meticulously sift through numerous documents, including payment stubs, employment records, financial transactions, and rent payments, among others, to evaluate borrower creditworthiness, which is time-consuming and prone to errors.

Such high volumes of paperwork increase the likelihood of inadvertently overlooking critical information, resulting in the approval of high-risk loans.

An automated mortgage underwriting system utilizes Natural Language Processing algorithms and predictive analytics. These capabilities enable the solution to swiftly and intelligently discern specific trends within numerous borrower documents. This efficiency liberates manual underwriters, allowing them to focus their expertise on the assessment of more intricate loan applications.

5. Borrower Credit Decisioning

Mortgage credit decisions rely heavily on human judgment, which can be challenging for retail mortgage lenders with diverse policies and rules for loan approval. The absence of standardized template rules for human underwriters can lead to confusion. While robots cannot replace human judgment, automated underwriting systems can complement human decision-making, facilitating more effective credit assessments.

The latest automated mortgage underwriting systems feature graphical editors for designing, implementing, and testing credit decision models. These models are constructed using machine learning algorithms across various programming languages, enabling swift deployment of real-time ML-based credit assessment functionalities. This automation streamlines all credit decision-related workflows, resulting in heightened efficiency and precision across the entire process.

Automated Mortgage Underwriting Functionalities

Mortgage underwriting automation systems can automate various stages involved in the loan application process, eliminating the need for manual intervention, and serve several critical functions, including:

- Indexing Engine: The technology accurately identifies over 350 document types with 95% accuracy using OCR, Computer Vision, and Machine Learning.

- Rule Engine: Mortgage underwriters must possess a comprehensive understanding of current regulations, compliance changes, and new rules. Automated systems offer highly effective solutions for managing large volumes of regulations effortlessly.

- Data Extraction Engine: Accurately extract data from various documents, including income statements, loan closures, etc.

- Report Engine: Automated mortgage underwriting systems are exceptional at generating reports for mortgage underwriting. They can analyze job trends, create tailored reports covering all aspects, and report on almost all data points in the system.

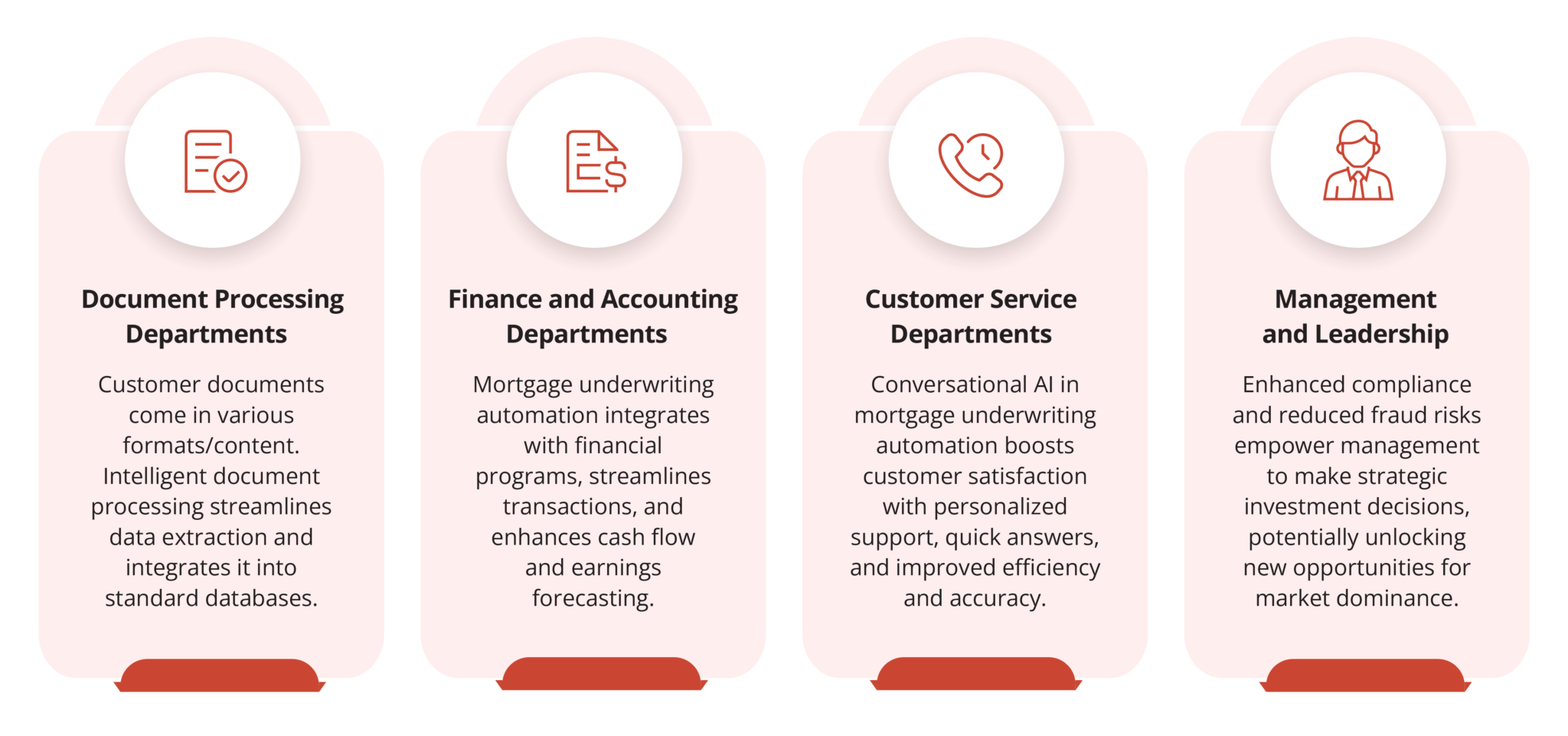

Who Benefits From Automated Mortgage Underwriting?

Mortgage underwriting automation opens the doors to an entire world of opportunities and benefits various departments in a mortgage institution, including:

When it comes to Data warehousing, it refers to the process of managing huge volumes of data collected from different sources. Traditional approaches use on-premise software and hardware solutions for data warehousing. Below are some common challenges associated with traditional data warehouse solutions include the following:

- Scalability: Traditional data warehouse solutions often require costly hardware and software upgrades in order to accommodate larger amounts of information.

- Complexity: Traditional data warehouse solutions may require specialist skills for management and upkeep.

- Cost: Traditional data warehouse solutions may be costly to set up and maintain for smaller and midsized companies.

- Limited flexibility: Traditional data warehouse solutions often lack the flexibility necessary for smooth integration with other sources or platforms.

How Do Automated Mortgage Systems Simplify the Underwriter's Role?

Mortgage lenders deploying automated underwriting systems can reduce loan processing times, identify inconsistencies, and drastically enhance the customer experience. Below, we will delve into some of the benefits of digitizing the mortgage underwriting process:

Assistance in Decision-Making: Leverages NLP to interpret content and extract essential data elements like property descriptions, ownership history, liens, and encumbrances.

Unassisted Data Analysis: AI simplifies mortgage underwriting by consolidating information, analyzing data, and generating error-free reports, reducing redundant tasks and processing time.

Secure Document Retrieval: AI-driven virtual assistants facilitate secure document distribution for underwriters. Borrowers and lenders can request and access documents 24/7 via text or mobile devices, simplifying the process.

Efficient Customer Experience: Automated systems increase customer satisfaction by providing faster mortgage approvals, and customizable status updates on the process or alerting applicants about pending documents.

Conclusion

Automated Mortgage Underwriting systems and other intelligent technologies have evolved from mere convenience to a transformative force in the mortgage sector. As we move forward, the industry must embrace these developments as a catalyst for progress. Harnessing its potential enables lenders to lead the competition, build a resilient sector, and foster an efficient and precise mortgage underwriting environment.

Experience a revolutionary shift in your underwriting process and customer satisfaction by connecting with experts at AppTek Corp today to learn about how automated mortgage underwriting systems can improve mortgage underwriting!

Modernize Mortgage Experiences NOW!