Agentic AI in Finance & BFSI : Real Use Cases Worth Watching

Experience Unified Digital Mortgage Solutions,

Powered by AI and Automation

Leverage the power of AI and automation to elevate your digital mortgage services. Our holistic approach focuses on designing customer-centric journeys that ensure unparalleled simplicity and efficiency from pre-qualification to closing.

Why Lenders Are Switching to the Digital Mortgage Process

Experience streamlined mortgage processing with AI and Automation offering fast, accurate, personalized mortgage solutions tailored to your unique requirements.

15%

Reduction in cost per

customer

15-20%

Improvement

in turnaround time

80%

Increase in satisfaction rate with minimal error rates

Drive faster loan approvals and elevate borrower experiences

Cut out manual delays and improve consistency across every stage of the loan process. See how automation helped a US-based mortgage provider accelerate approvals and optimize operational efficiency.

Pre-Qualification

Empower borrowers with clarity and control through our comprehensive mortgage pre-qualification solutions.

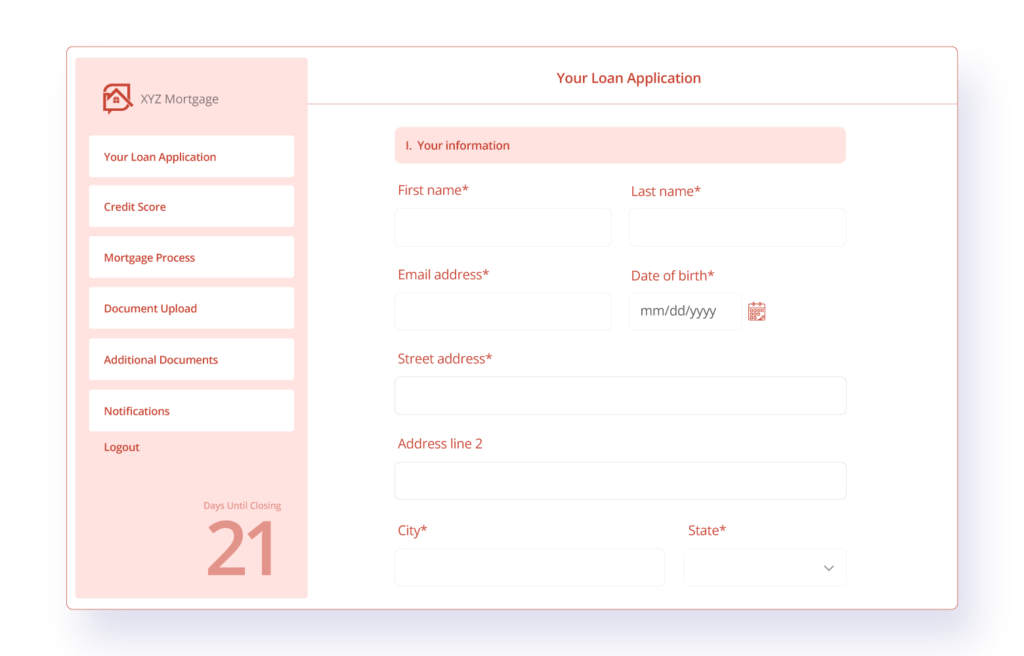

Borrowers can self-register through a portal, empowering them with the convenience to manage and update their basic financial information, such as income, savings, and investments, as well as debt and credit score range.

Through a self-service portal, borrowers securely upload mortgage documentation and digitally submit them for verification.

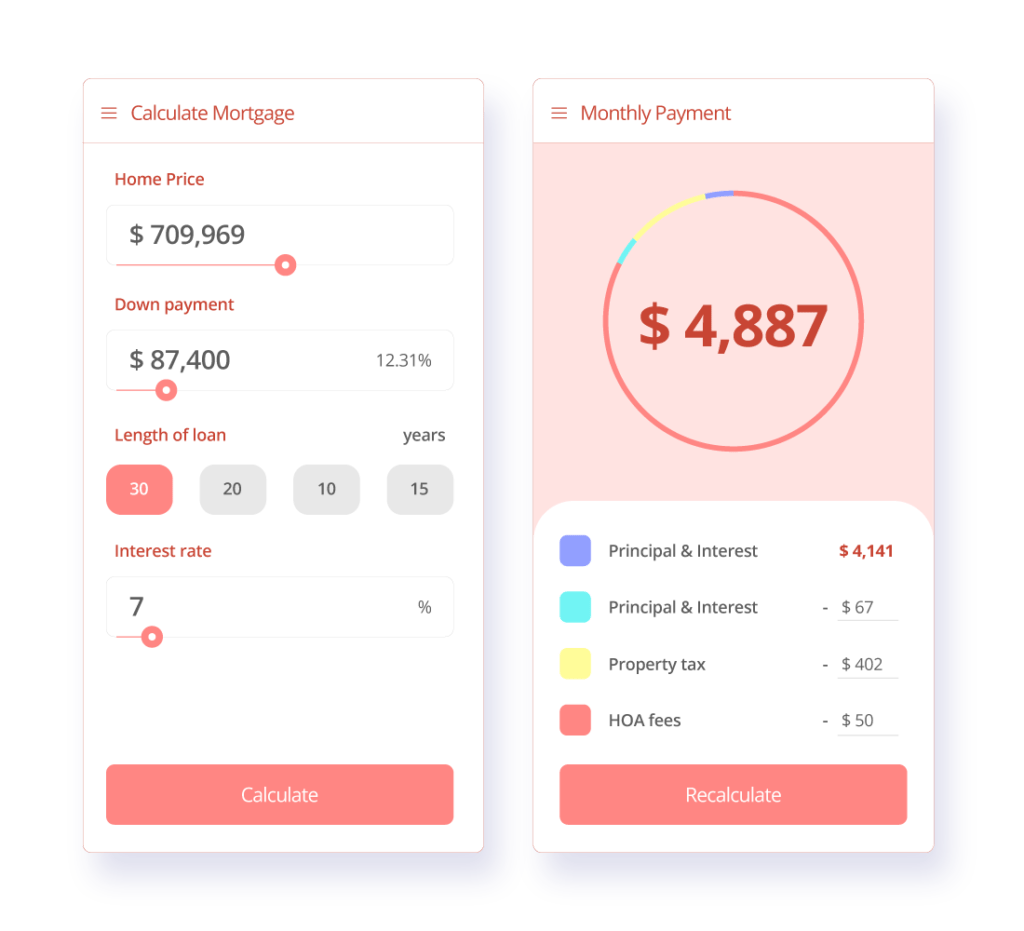

Powered by Automation/RPA, the mortgage calculator automatically computes accurate monthly payments by considering home price, down payment, mortgage term, and interest rate.

Creation of an online mortgage application template, ready for immediate publication, and personalized to suit the lender’s preferences and legal obligations, achieved through the utilization of predefined inputs furnished by the lender.

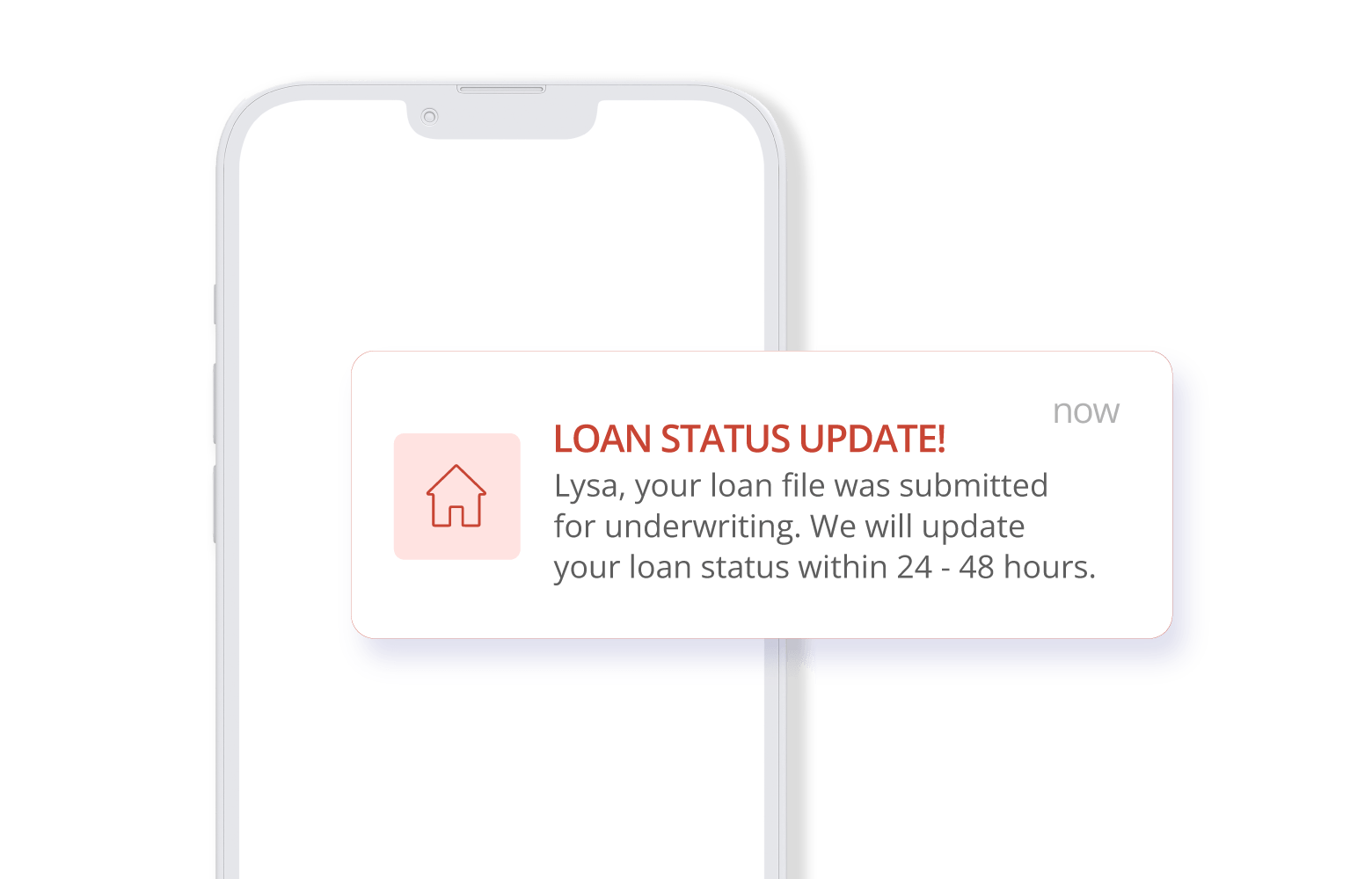

Through automation or RPA, borrowers are notified of changes in mortgage loan statuses, upcoming repayment deadlines, expiring documents requiring renewal, and other pertinent updates.

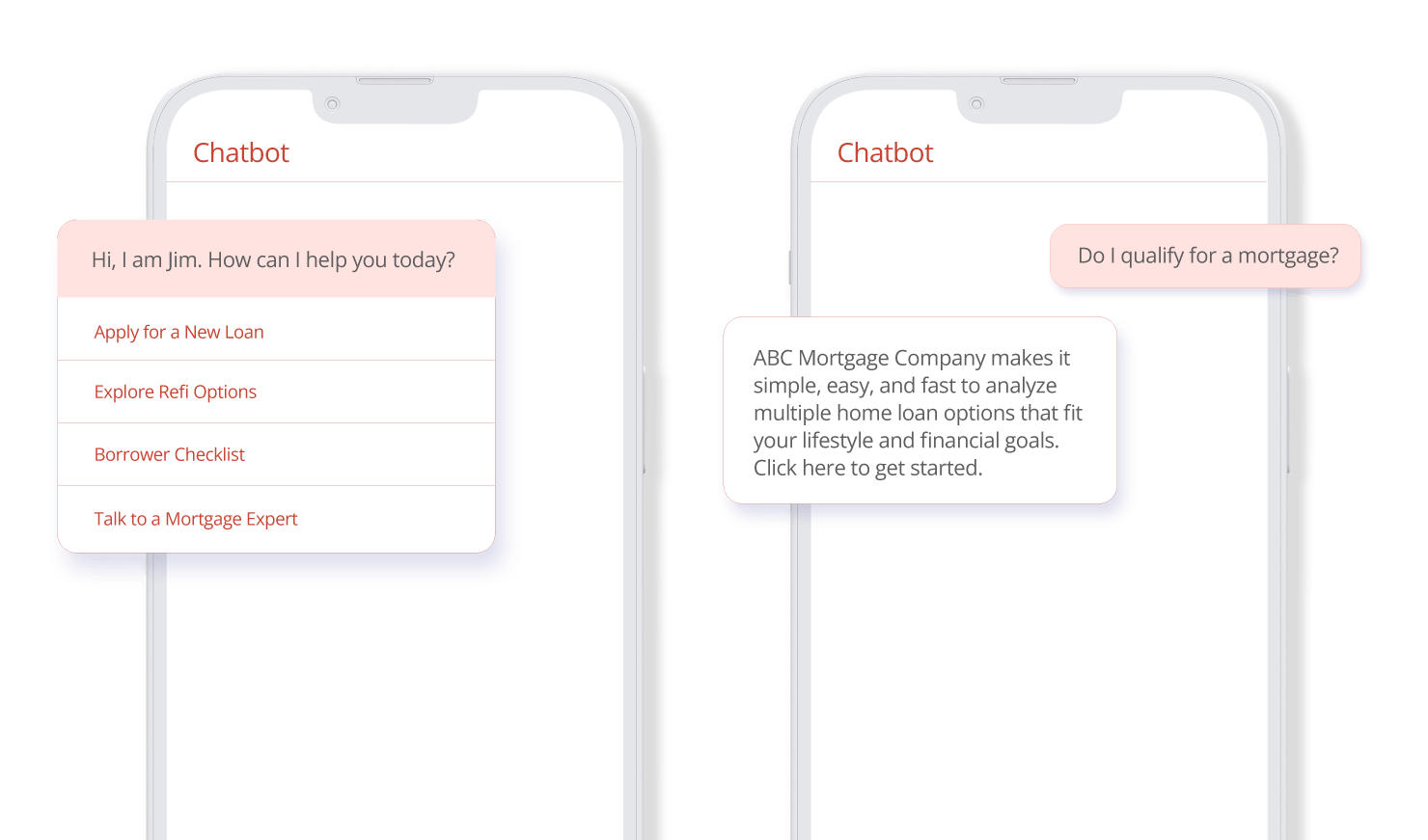

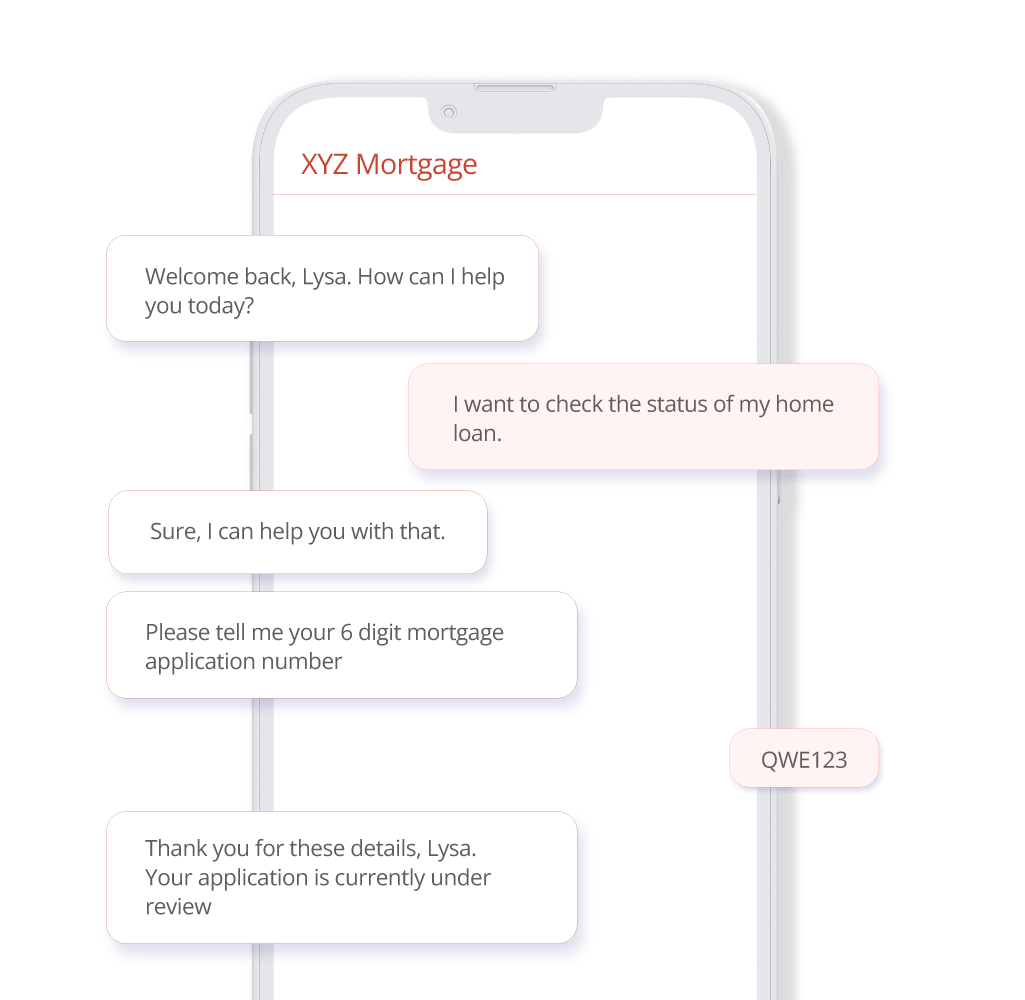

AI-powered virtual assistants offer instant answers to mortgage-related questions, assist with technical and security issues, and clarify mortgage terminology.

Application Processing

Transform your approach to mortgage document processing by harnessing the sophistication of AI-enhanced document analysis, automation, and machine learning, infusing every decision with precision and simplicity.

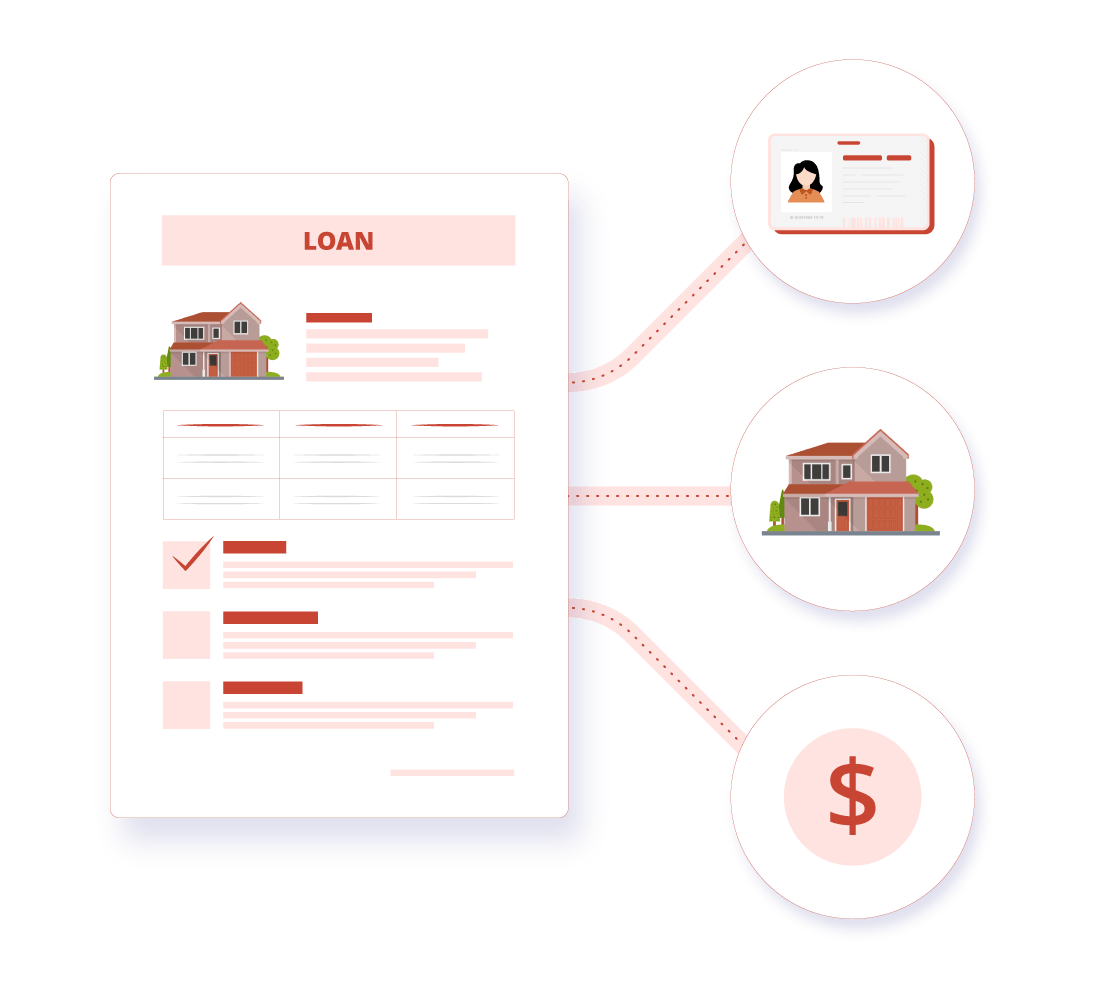

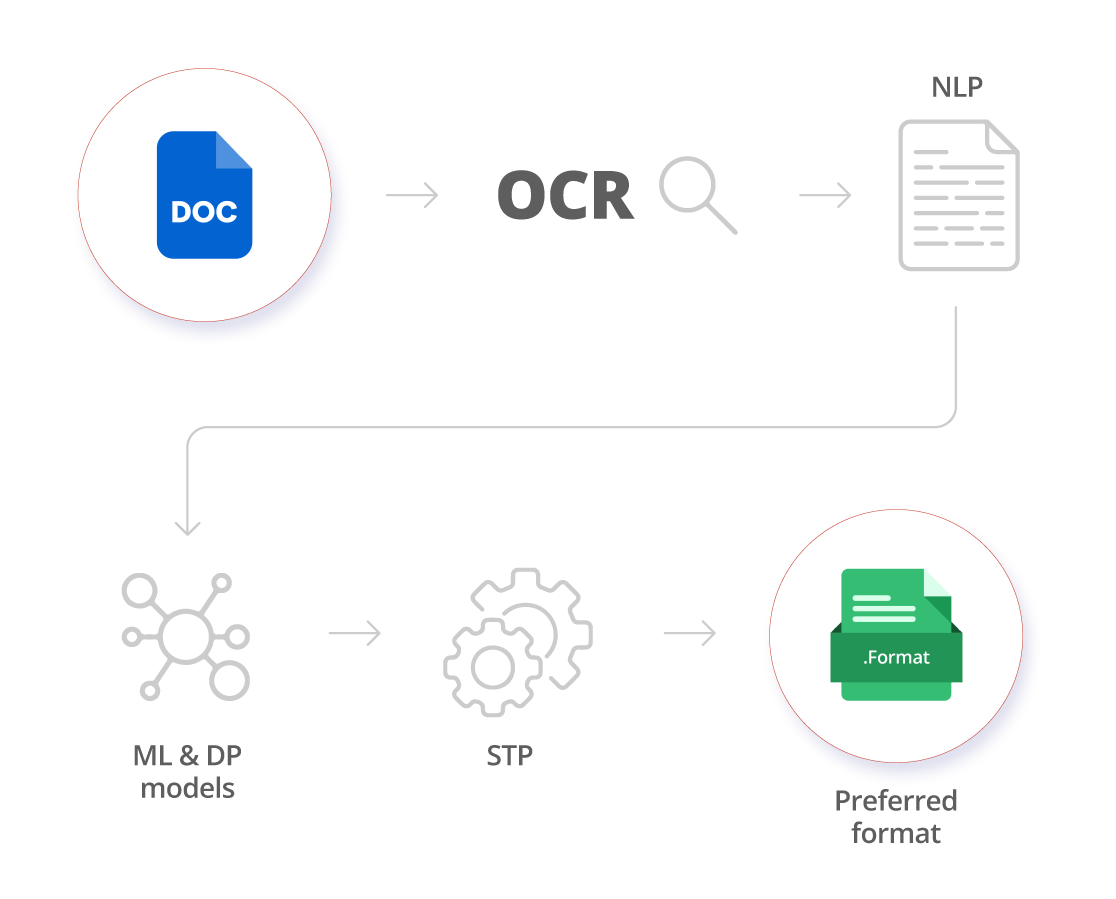

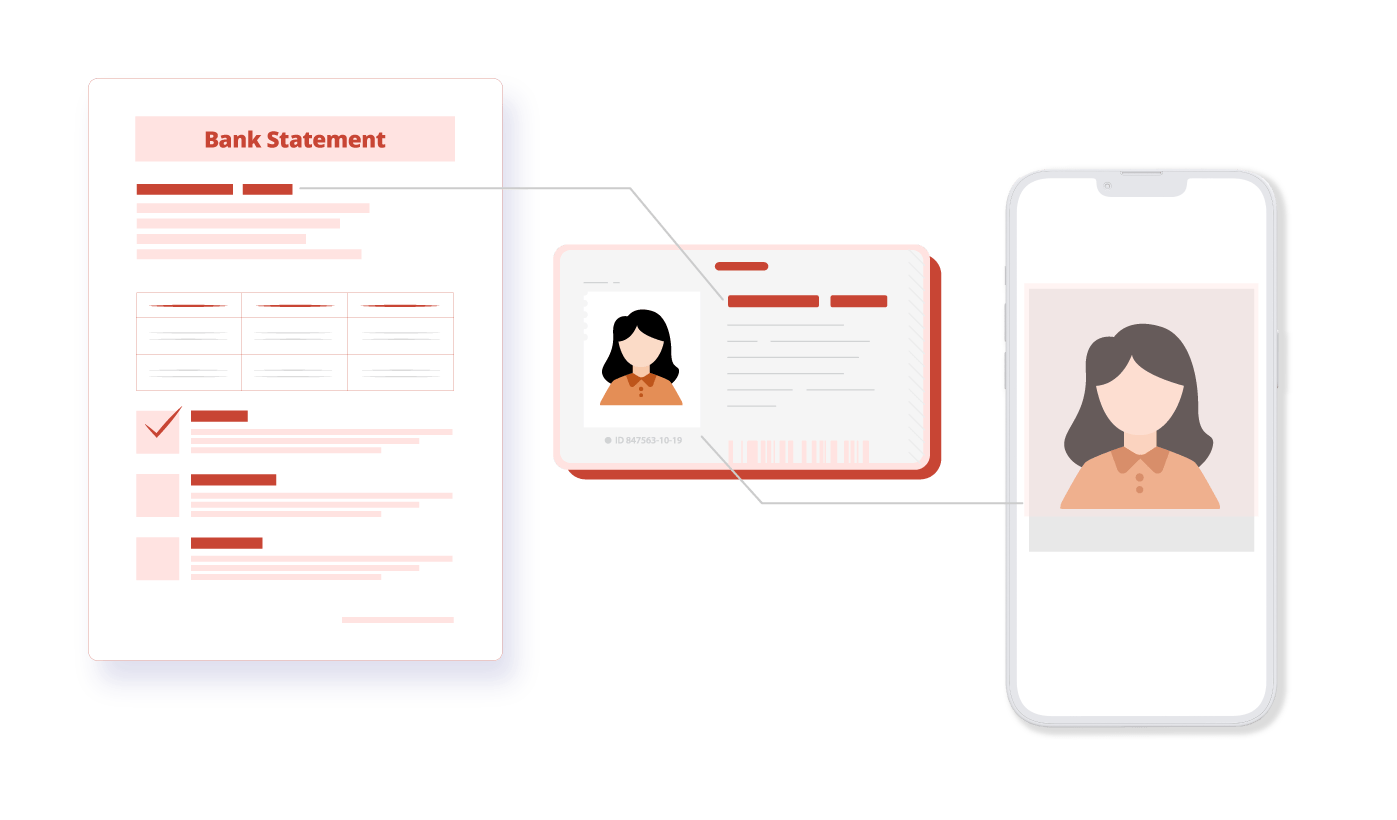

Leverage Intelligent Document Processing and Automation to extract, transform, and load borrower data from mortgage documents, encompassing income, assets, and liabilities, into a database for swift processing.

Harness Natural Language Processing coupled with Machine Learning to automatically extract insights and connections in text, classify documents, and perform Name Entity Recognition (NER) and topic modeling.

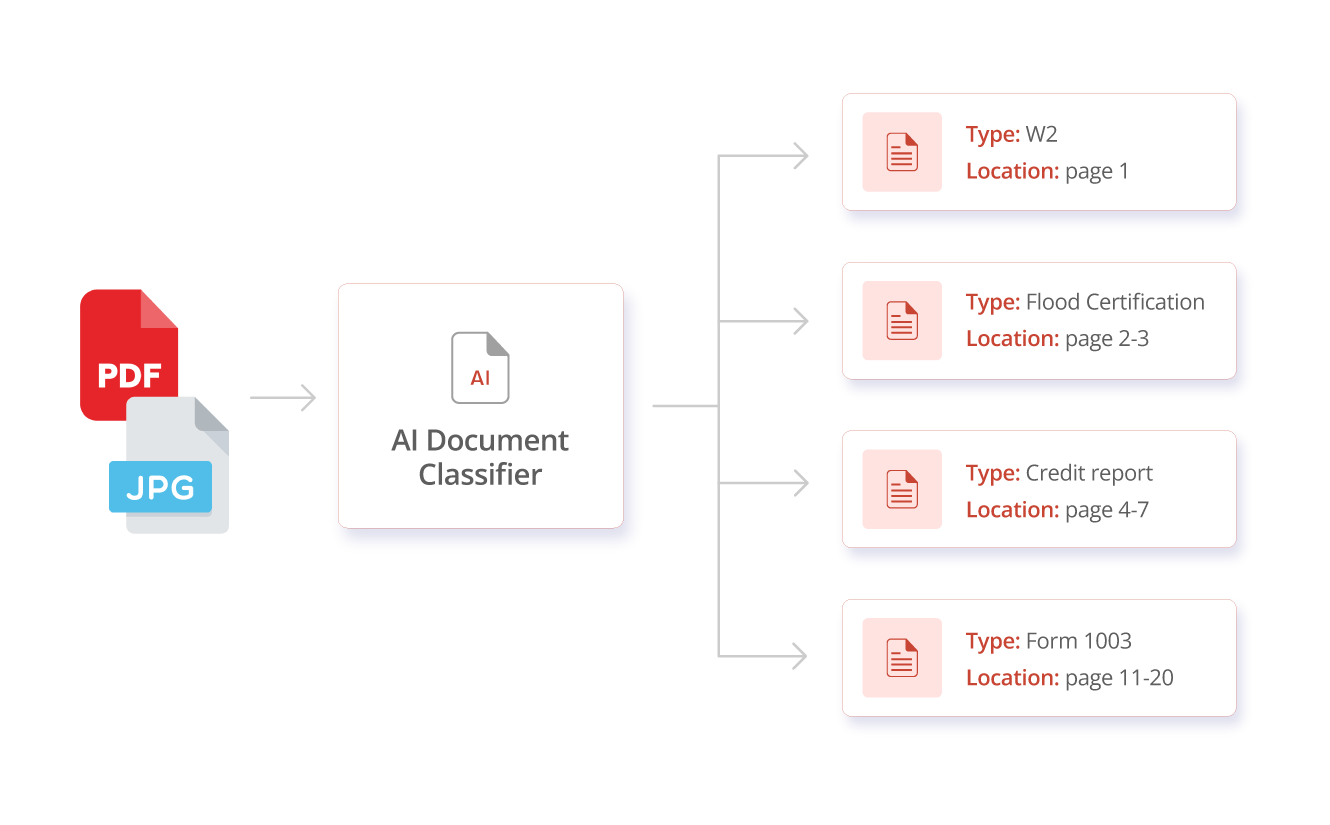

Deploy Intelligent Document Processing and Automation to distinguish and categorize documents, including medical reports, bank statements, cash flow reports, P&L statements, and more.

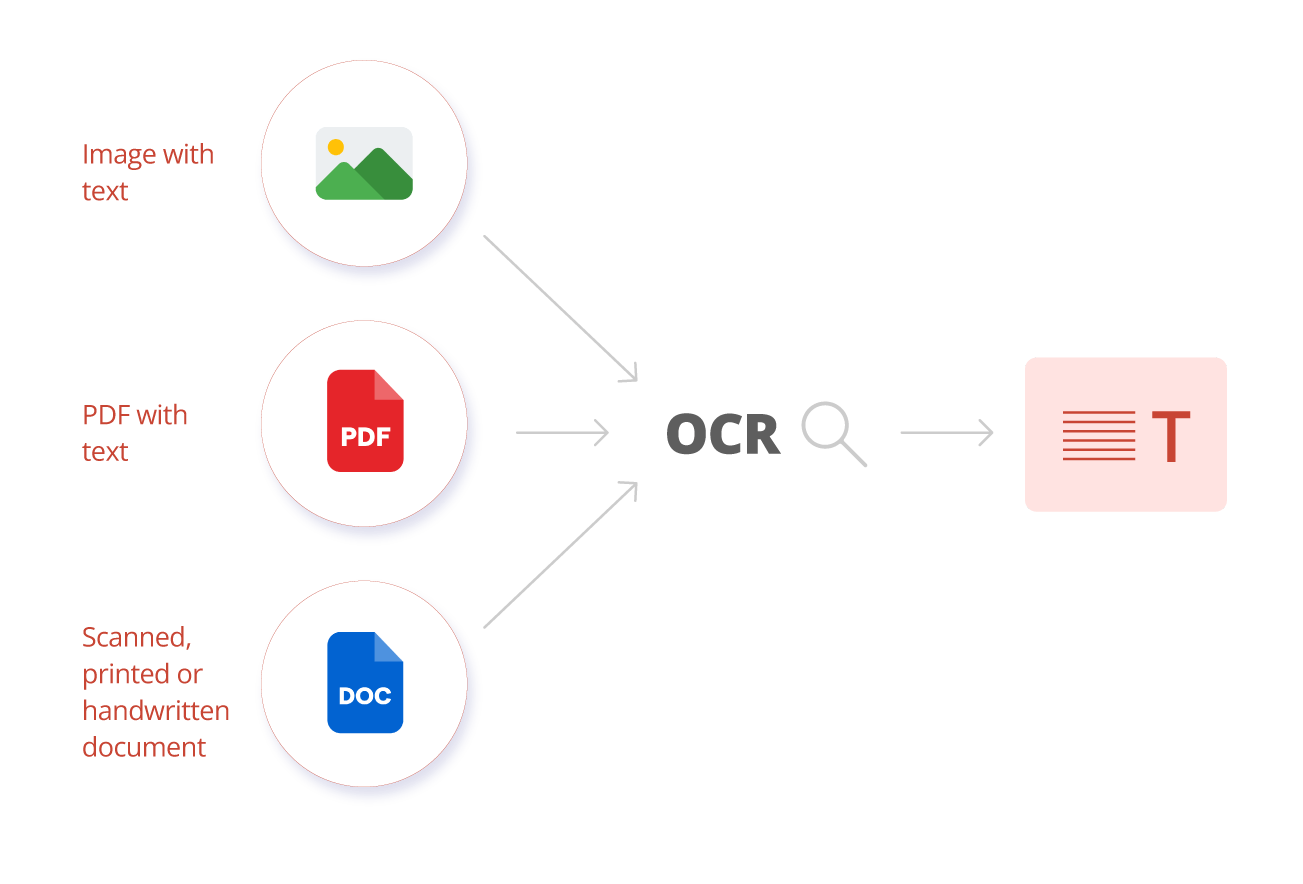

Automatically convert documents into pre-defined machine-readable digital formats without the necessity for manual data entry through Optical Character Recognition (OCR).

Leverage Artificial Intelligence to audit and flag absent documents and data fields in individual documents and validate borrower data against public credit rating platforms.

Using AI and automation, documents are automatically converted to searchable PDFs with entities highlighted and bookmarked chronologically per user inputs. In incomplete applications, agents are supported by a chatbot, while loan officers are alerted to mismatched borrower data for manual handling.

Employ AI, OCR, and Automation for geographic-based KYC/AML verification of borrower documents like ID cards, face/biometric authentication, and utility bills.

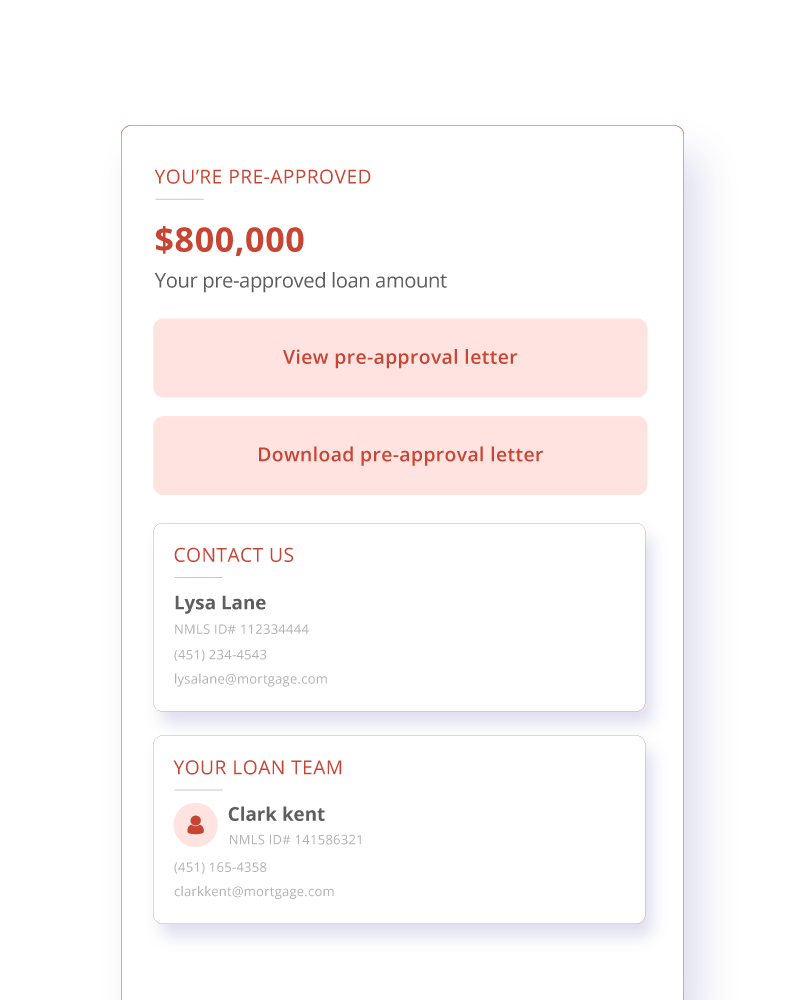

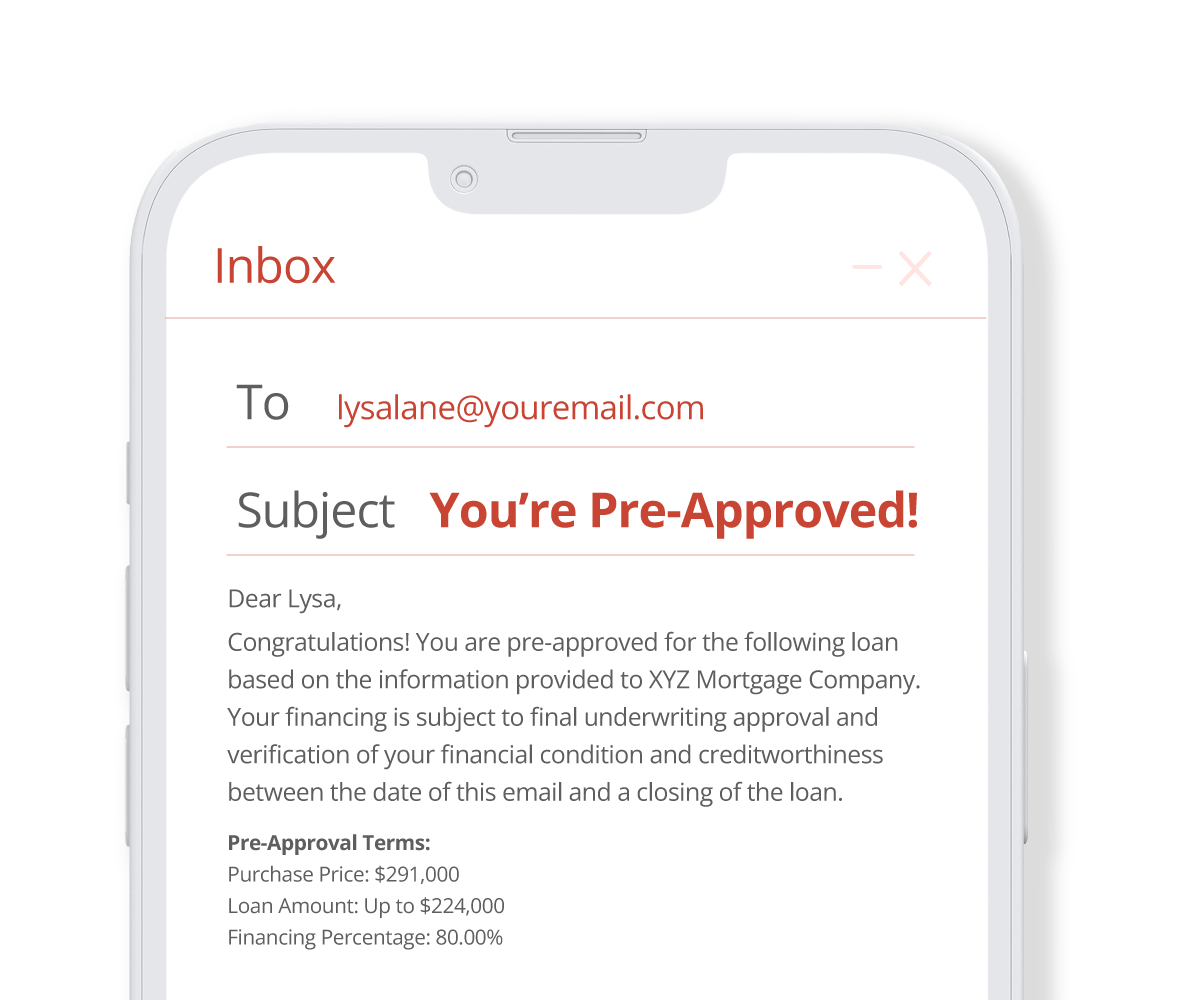

Utilize Automation to optimize and streamline generating and dispatching pre-approval letters to eligible borrowers based on validated data.

Underwriting

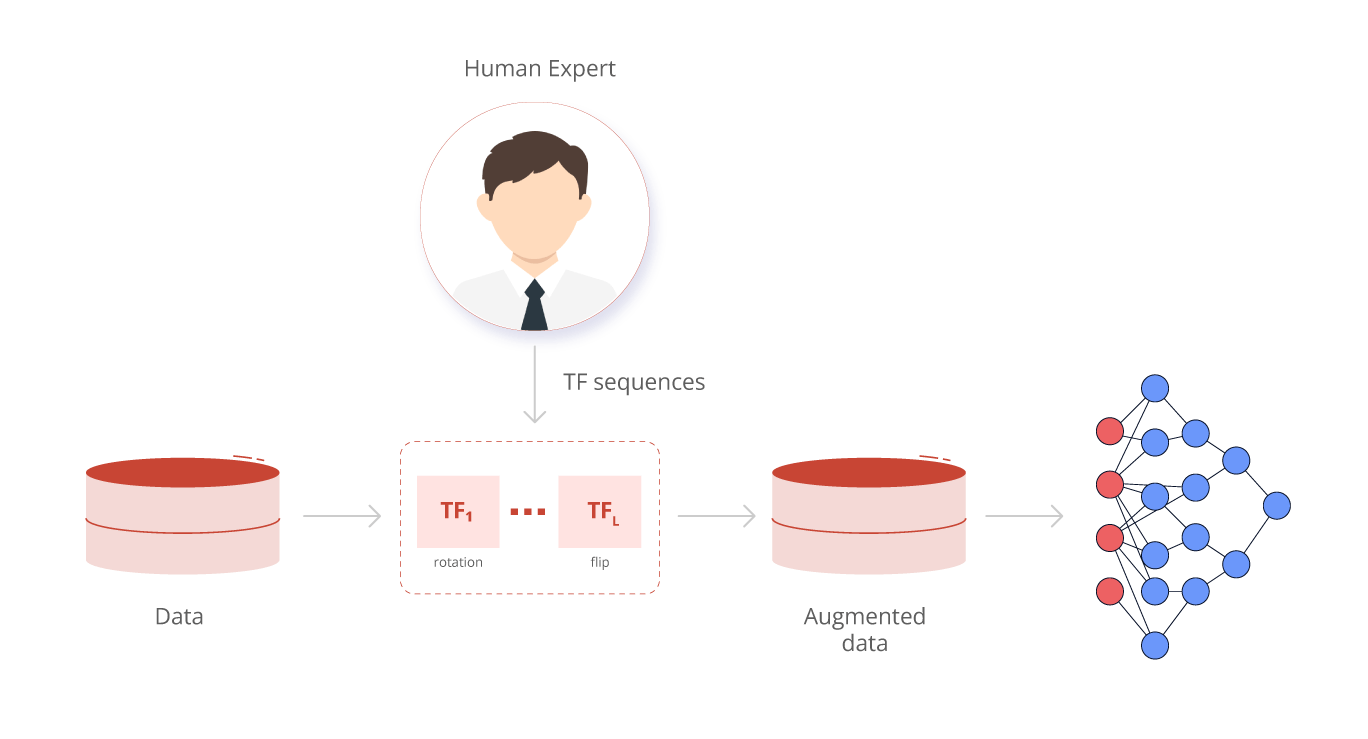

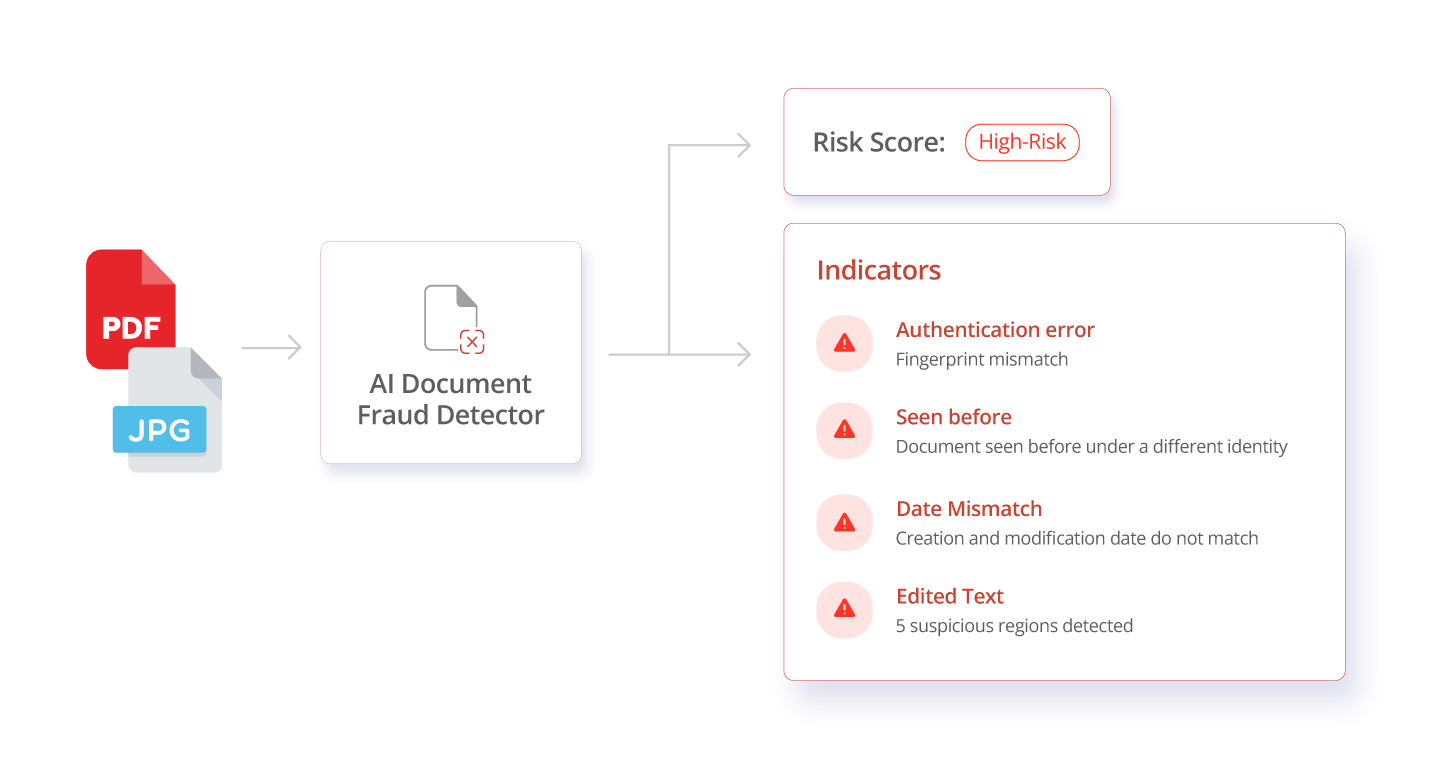

Integrate AI, ML, and Automation to streamline Mortgage Underwriting for fraud detection, accurate risk predictions, faster credit decisions, and overall, foster a more inclusive lending environment.

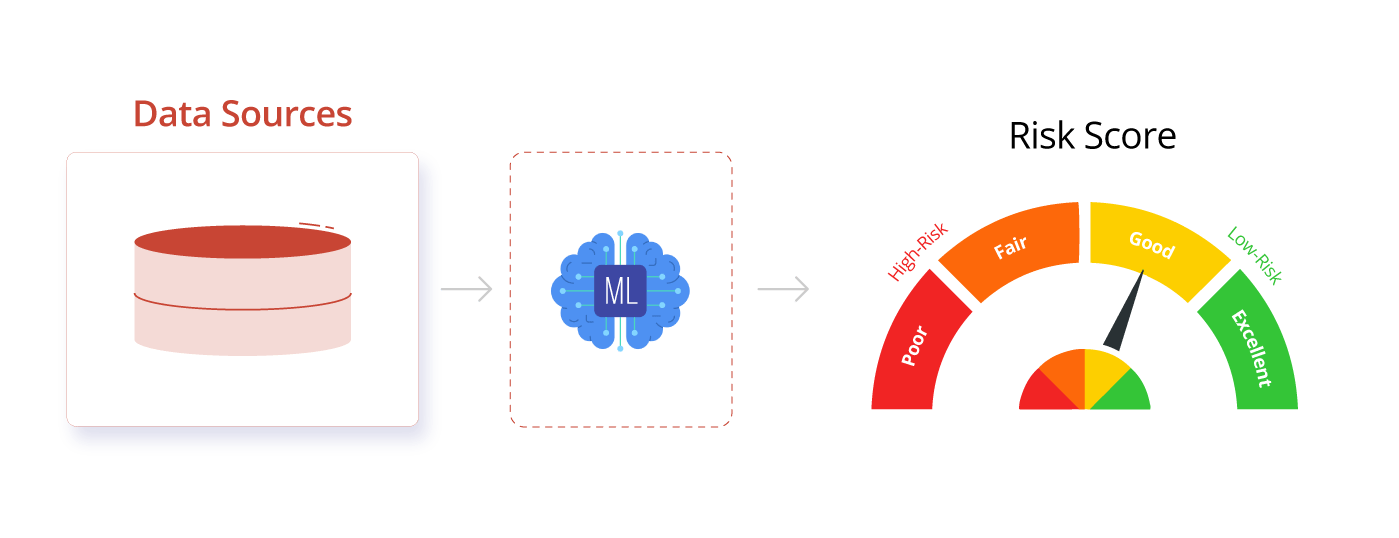

Employ Artificial Intelligence and Automation to evaluate borrower credit risks, analyzing factors such as credit history, spending behaviors, income stability, and other relevant data points.

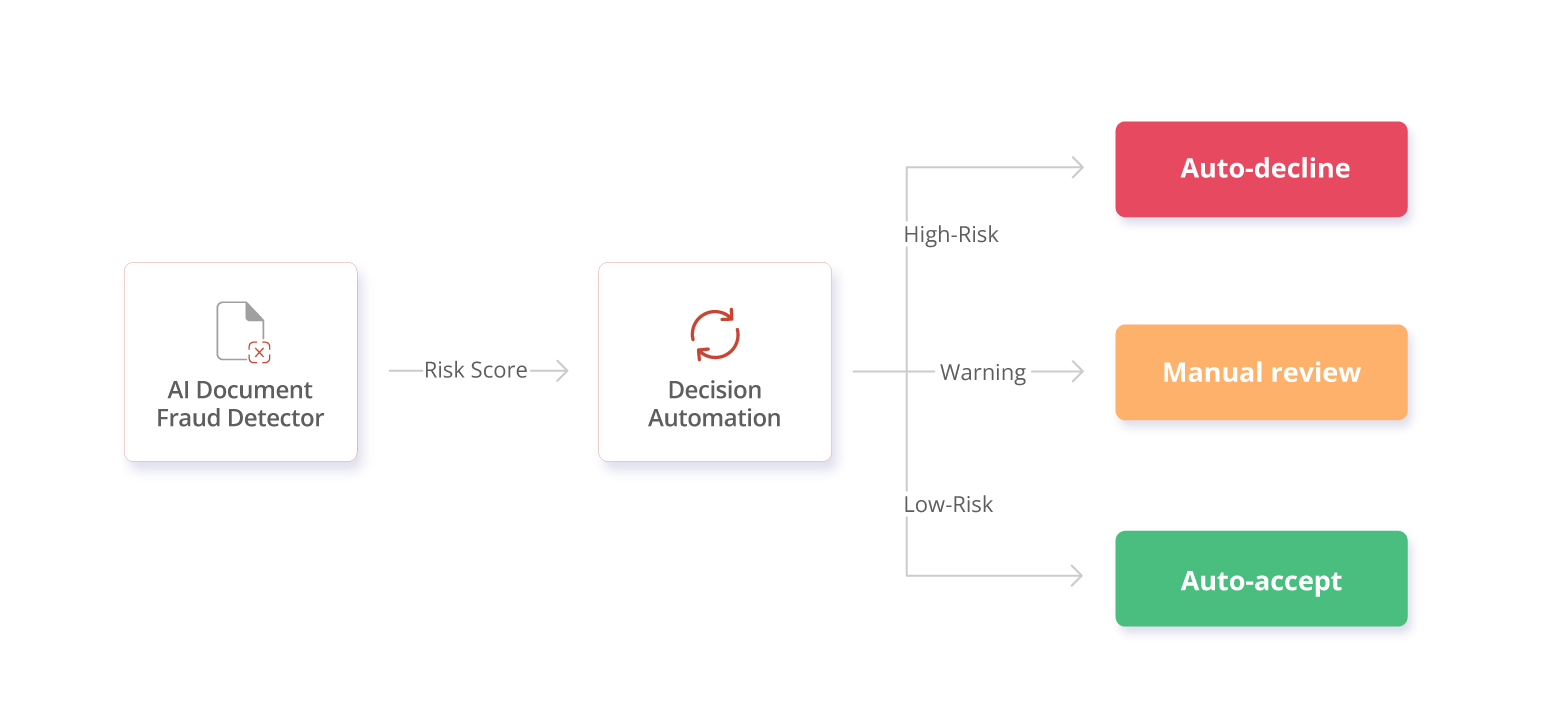

Automatically extract and analyze data against pre-defined parameters, flagging potential tampering. It utilizes AI-enabled computer vision to identify forged pixels within documents and leverages ML-driven Predictive Analytics to anticipate suspicious activity – empowering lenders to minimize fraudulent mortgage approvals and safeguard future transactions.

Utilize Machine learning to score and prioritize risk. Segment borrowers according to credit risk level, allowing for tailored loan management and configuring mortgage loan limits for each segment.

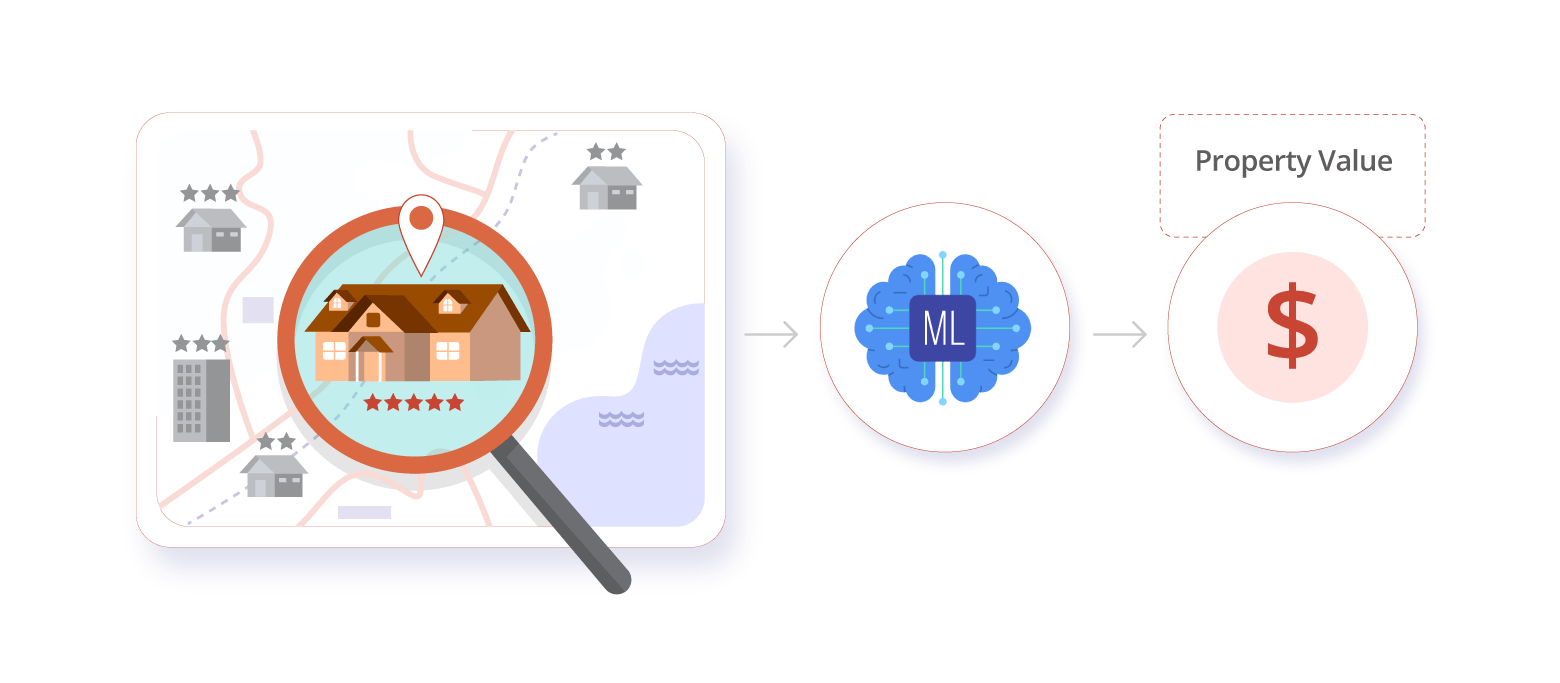

Deploy computer vision for real-time image and video analysis to uncover property insights and aid insurers in identifying items of value. Integration with GIS and GMaps facilitates quick neighbourhood risk assessments.

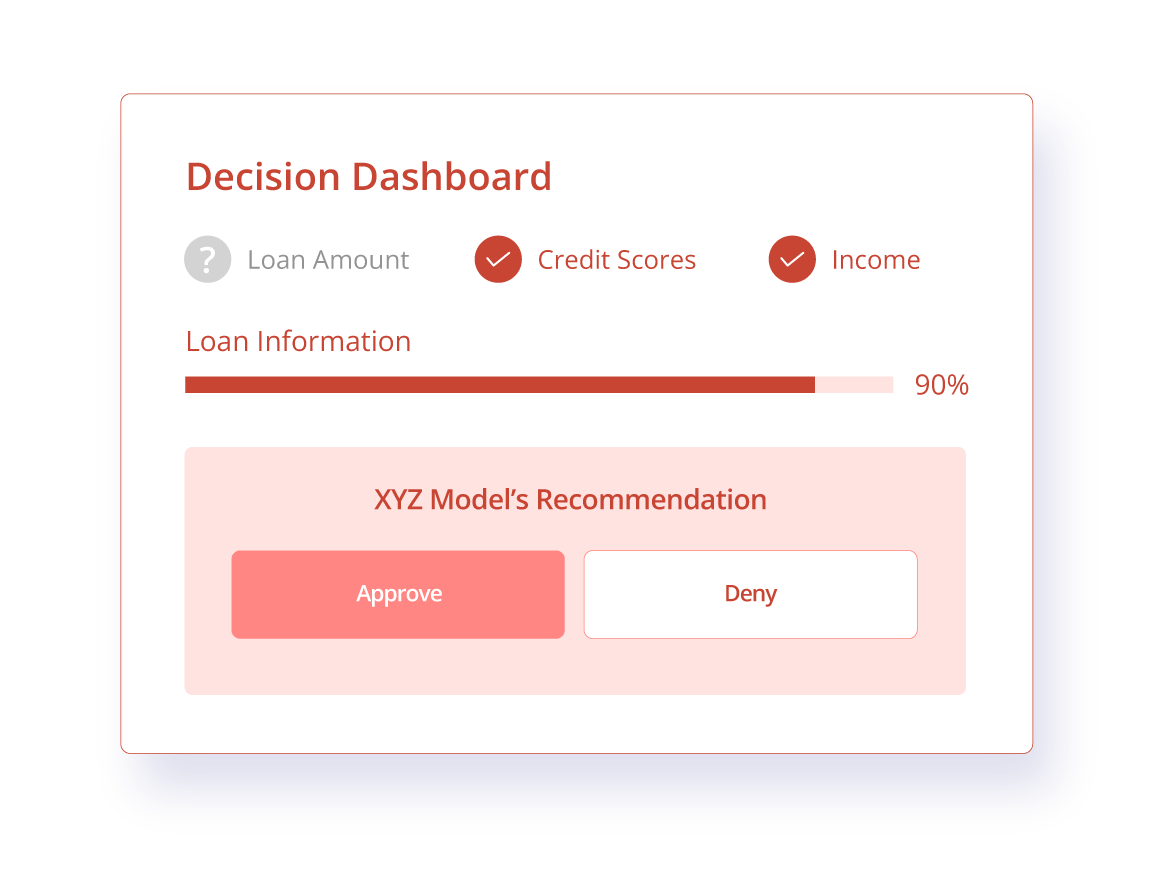

Automation streamlines mortgage pre-screening with a risk model, fast-tracking suitable ones for pre-approval and sending high-risk ones for underwriter review. Relevant borrower insights are extracted automatically, aiding underwriters in making efficient, accurate decisions.

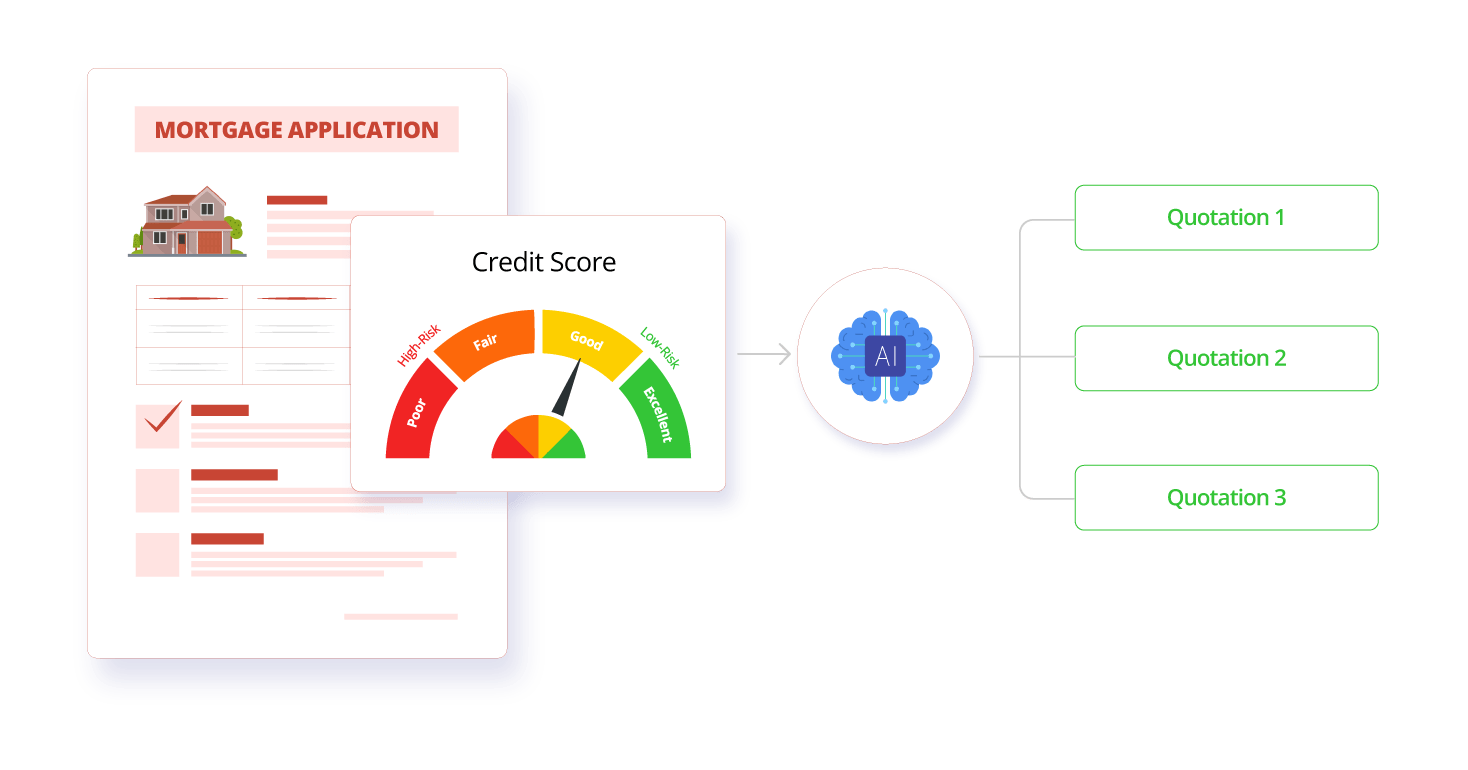

Leveraging AI, a recommendation engine suggests loan rates to the underwriter based on the borrower’s risk profile. The underwriter then assesses the quotation and loan terms. Low-risk borrowers receive real-time quotations generated by ML-driven engines.

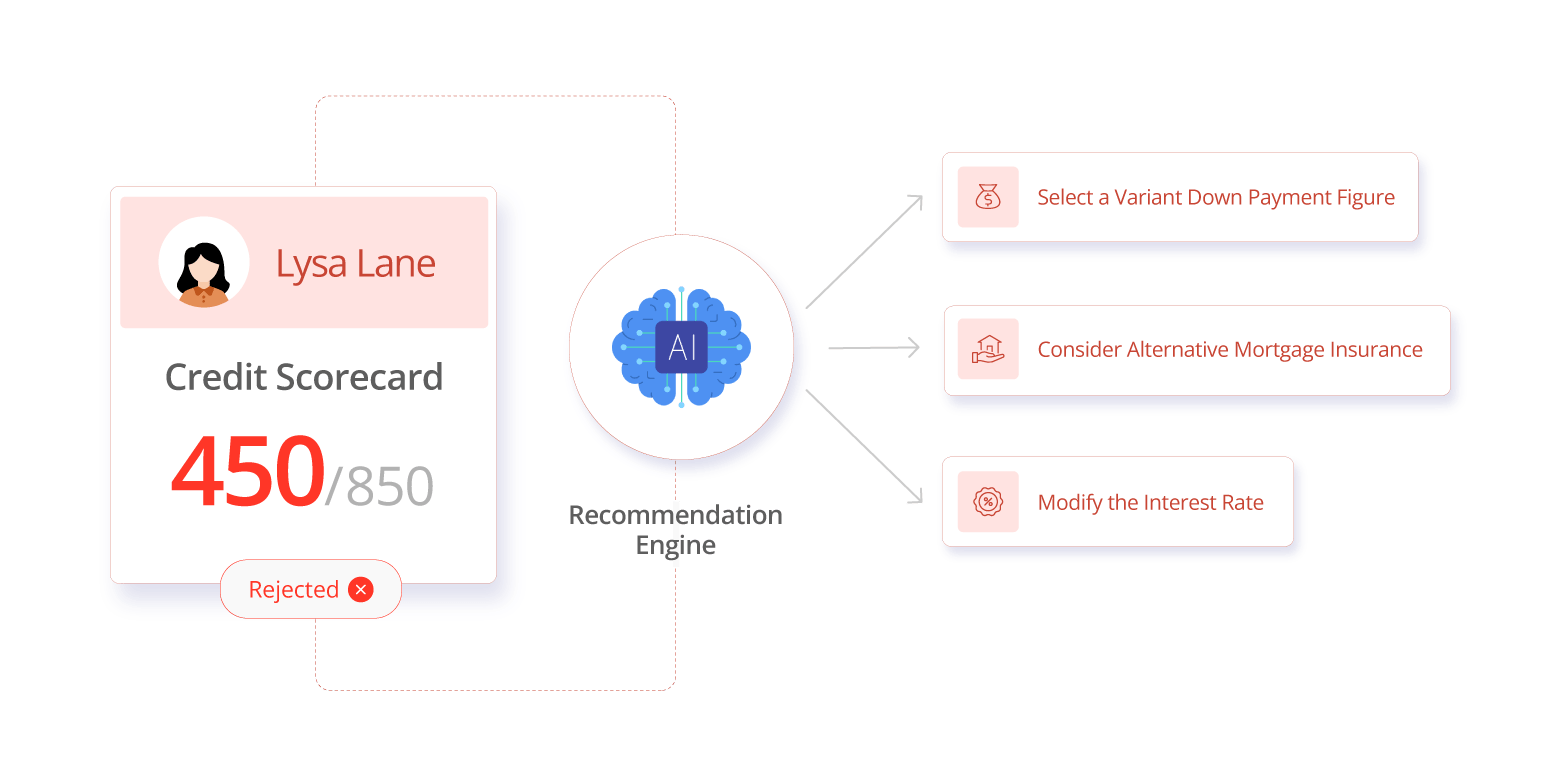

Utilizing AI, automatic suggestions for alternative mortgage terms, including down payment amount, mortgage insurance, and interest rates, are offered to the borrower following the initial application decline.

Through automation, pre-approval letters outlining available mortgage amortization scenarios are generated and subsequently sent to the borrower via email or a customer portal.

Decision & Closing

Transform the mortgage eClosing experience with the integration of AI and automation, achieving a workflow optimized for efficiency and flexibility and characterized by absolute transparency.

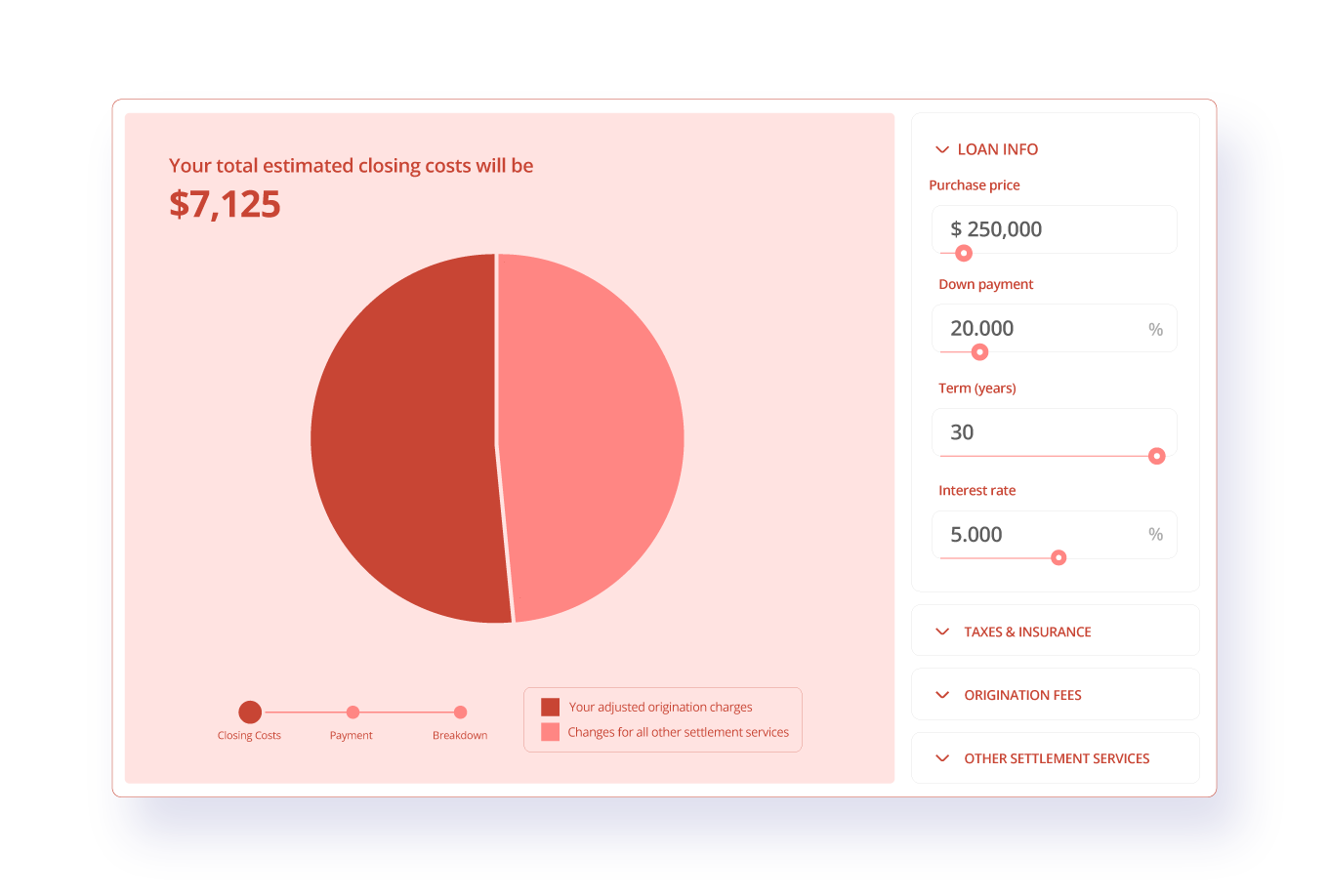

Using automation, down payment, escrow, APR, and closing fees are automatically computed, including loan application, credit report, upfront mortgage insurance, flood determination, owner’s title, and real estate commissions.

Creating a customized policy template for amortization schedules, meeting the lender’s preferences and legal requirements. It includes a detailed timeline of periodic loan payments, indicating the principal and interest for each payment until the loan term ends.

Using automation, closing disclosure documents are generated automatically, comprising a good faith estimate, a truth-in-lending disclosure statement, a HUD-1 settlement statement, and other necessary forms.

Utilizing automation, a flexible mortgage document approval workflow is established, securing approvals from both internal stakeholders and borrowers.

Utilizing automation, disclosures and loan documents are electronically delivered to the borrower for review and signature. Borrowers may choose from various eClosing options, including Hybrid, Hybrid with eNote, RON, or IPEN.

Generation of a deed of trust is automated, activated by the receipt of the pre-agreed down payment from a borrower, and then submitted to local title registration authorities for the finalization of property ownership transfer.

AI-powered Virtual Assistants streamline the closing process by answering client queries about costs and payments, providing document checklists, and real-time status updates. They also send automated reminders for key deadlines and collect feedback to enhance the borrowing experience.

Ready to power faster closings with automation?

Break Down Silos for Seamless Mortgage Experiences with Capten.ai

Build or modernize mortgage applications with our AI-powered code generation platform. Leverage cloud-native technologies to create unified, responsive experiences for your lending teams and borrowers, and stay ahead of the competition.

- Accelerate application modernization with streamlined, automated code generation.

- Embed security and compliance at the onset of development for robust protection.

- Enhance integration with modern functionalities via RESTful interfaces.

- Address skill disparities through the implementation of standardized processes.

- Achieve scalability effortlessly with framework-agnostic solutions.

- Implement a shift-left and shift-smart strategy for swift and secure code deployment.

Ready to scale your

digital journey?

Harness AI and Automation for Ideal Mortgage Lending Experiences

Blogs

Gather key industry insights and know our approach on digital solutions

Discover valuable insights tailored to your unique interests.