Table of Contents

The defensive posture that has defined AML banking compliance is losing effectiveness. Traditional detection environments now create false positive rates as high as 90 to 95 percent, leaving risk and technology leaders managing large-scale alert clearance operations rather than focused financial crime investigation.

Financial crime compliance is moving beyond basic automation into a new phase of technology adoption. The focus is shifting from simply processing alerts faster to enabling decision support at scale.

Agentic AI supports deeper analytical workflows by assessing activity in context, synthesizing signals across multiple data sources, building case-level insight, and assisting in the development of consistent, traceable compliance reporting, reducing reliance on purely manual analysis while maintaining control and oversight.

This technical guide details how to architect and deploy Agentic AI workflows to automate KYC and automate AML processes. We will dismantle the “black box” fear, proving that with the right architecture, enterprises can reduce operational costs by 50% while lowering the regulatory risk profile.

Why Agentic AI for KYC and Compliance Is Becoming Essential for AML Operations

The cost of compliance has become unsustainable. Manual KYC/AML processes are a drag on profitability and customer experience.

Cost Savings from Automating KYC AML Processes

Data from 2024-2025 reveals a widening chasm between legacy institutions and AI-native challengers. The efficiency gains from Agentic AI are not incremental; they are exponential.

| Metric | Legacy Rule-Based System | Agentic AI Architecture | Impact |

|---|---|---|---|

| False Positive Rate | 90–95% | 50–60% | 30–45% Reduction in wasted analyst hours |

| Investigation Time | 45–60 Minutes per Alert | 2–3 Minutes per Alert | 20x Faster case resolution |

| Onboarding Velocity | 3–5 Days | <10 Minutes | 90%+ Faster time-to-revenue |

| Operational Efficiency | Linear headcount scaling | Elastic scalability | 40–50% Efficiency Gain in narrative drafting |

Source: Industry analysis of 2025 AML trends and automation impact.

By 2026, it is projected that 70% of new account onboarding will be fully automated. The question for the C-suite is no longer “if” but “how fast.”

Read More: Why Agentic AI Is Replacing Rule-Based Automation in Banking

3 Real-World Use Cases for Agentic AI for KYC and Compliance

To understand how to automate without risk, we must look at specific scenarios where Agentic AI outperforms human teams in both speed and accuracy.

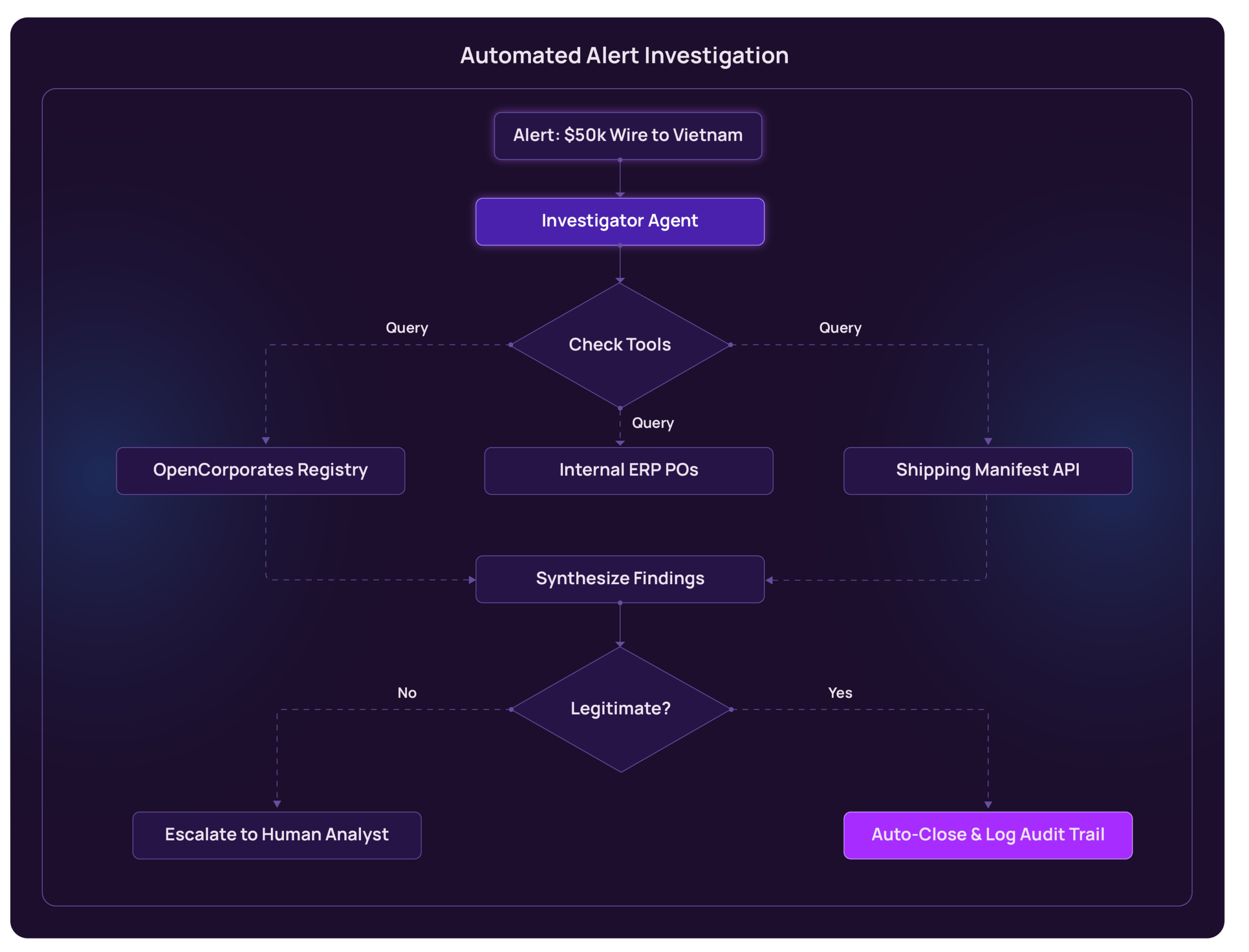

Use Case 1: The “False Positive” Wire Transfer

- The Scenario: A $50,000 wire transfer to a new vendor in Vietnam triggers a standard AML alert due to the jurisdiction and amount.

- Manual Process: An analyst spends 45 minutes logging into three different systems, checking Google Maps for the address, searching corporate registries, and reviewing the invoice.

- Agentic Solution: Upon alert, the Investigator Agent autonomously queries external registries, cross-references internal POs, and validates shipping data.

Result: The agent clears the alert in 2 minutes, appending a full audit trail and “Journal Support Pack” proving the transaction is legitimate. No human intervention required.

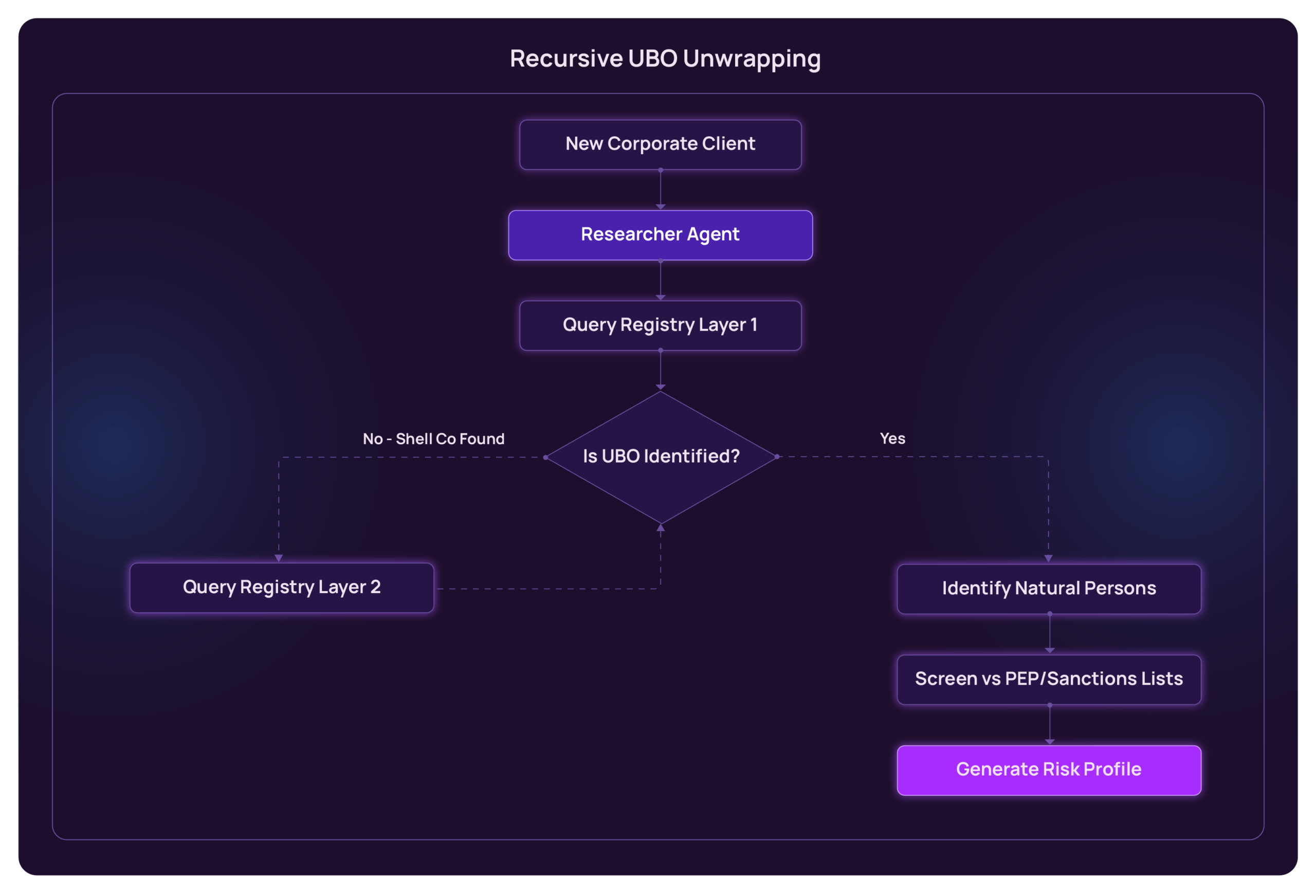

Use Case 2: Complex Corporate Onboarding (KYB)

- The Scenario: Onboarding a corporate client with a complex, multi-layered ownership structure involving shell companies.

- Manual Process: Days of back-and-forth emails to identify the Ultimate Beneficial Owner (UBO), often relying on self-attestation.

- Agentic Solution: A Researcher Agent recursively “unwraps” the corporate structure. It queries jurisdictional registries layer-by-layer until it identifies the natural persons at the top.

Result: Onboarding time reduced from 5 days to 10 minutes, with a higher degree of diligence than manual checks.

Use Case 3: Digital Mortgage & Source of Funds

- The Scenario: Verifying the “Source of Funds” for a large down payment, which involves reviewing messy, unstructured bank statements and gift letters.

- Manual Process: Loan officers manually highlight PDFs and calculate totals, leading to errors and delays.

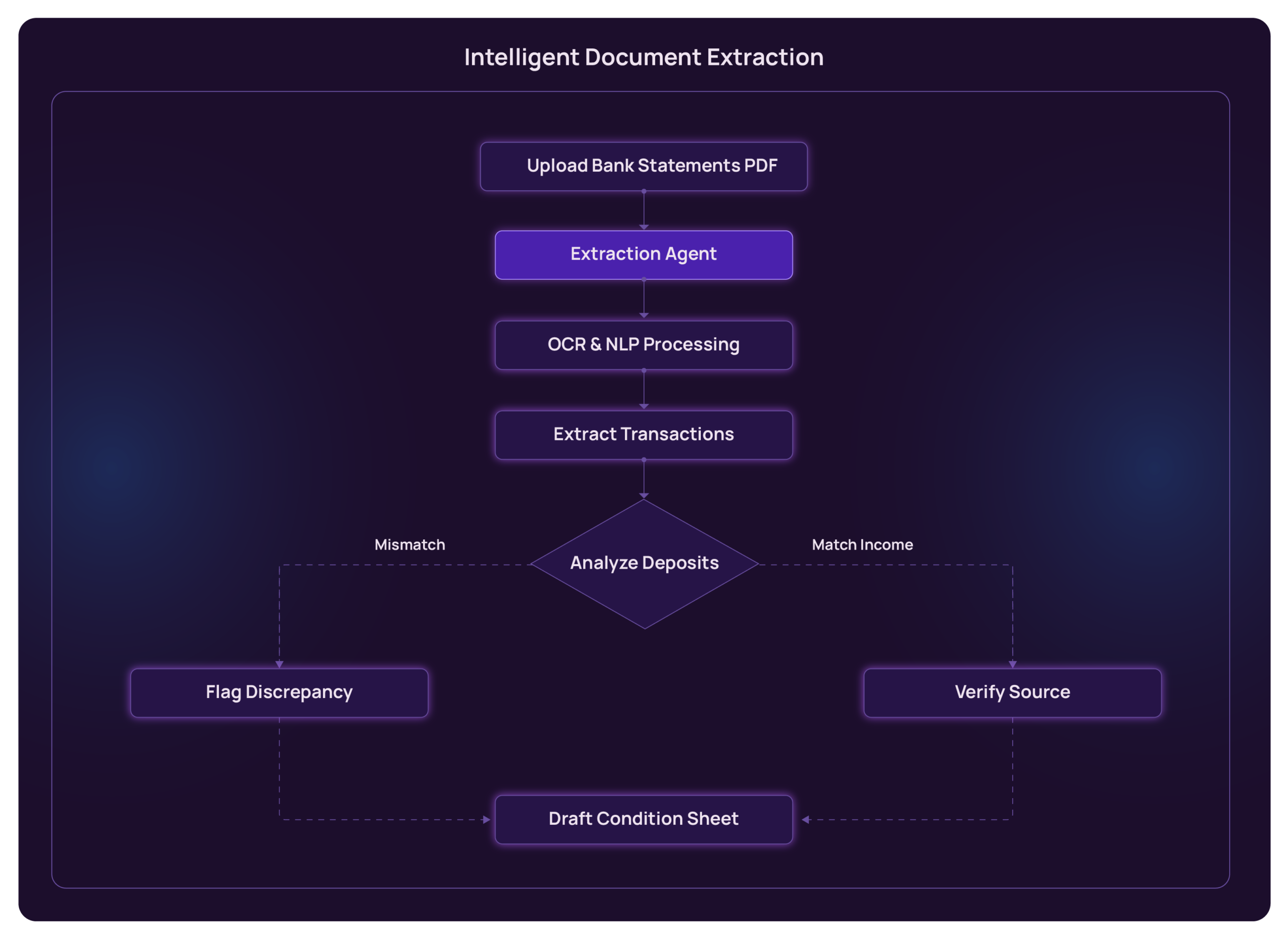

- Agentic Solution: An Extraction Agent uses OCR/NLP to read the PDF statements, identifies large deposits, and cross-references them with the borrower’s declared income.

Process Flow: Intelligent Document Extraction

Result: 90% faster processing and zero calculation errors.

Technical Architecture: Building the Agentic Investigator

To achieve these results, you must build systems based on the ReAct (Reason + Act) pattern, not just simple scripts.

The ReAct Pattern in Financial Crime

Unlike a standard LLM that just generates text, an Agentic AI system operates in a loop of reasoning and acting.

The Agentic Loop: A Technical Deep Dive

- Trigger: Transaction monitoring flags an alert.

- Observation: The Agent receives the payload.

- Thought (Reasoning): ”I need to verify if this beneficiary has a legitimate business relationship with the sender.”

- Action (Tool Use): The Agent calls the CRM_API and Google_Search_Tool.

- Observation: ”Sender is a textile importer. Beneficiary is a textile manufacturer.”

- Final Action: Auto-close the alert and draft a memo.

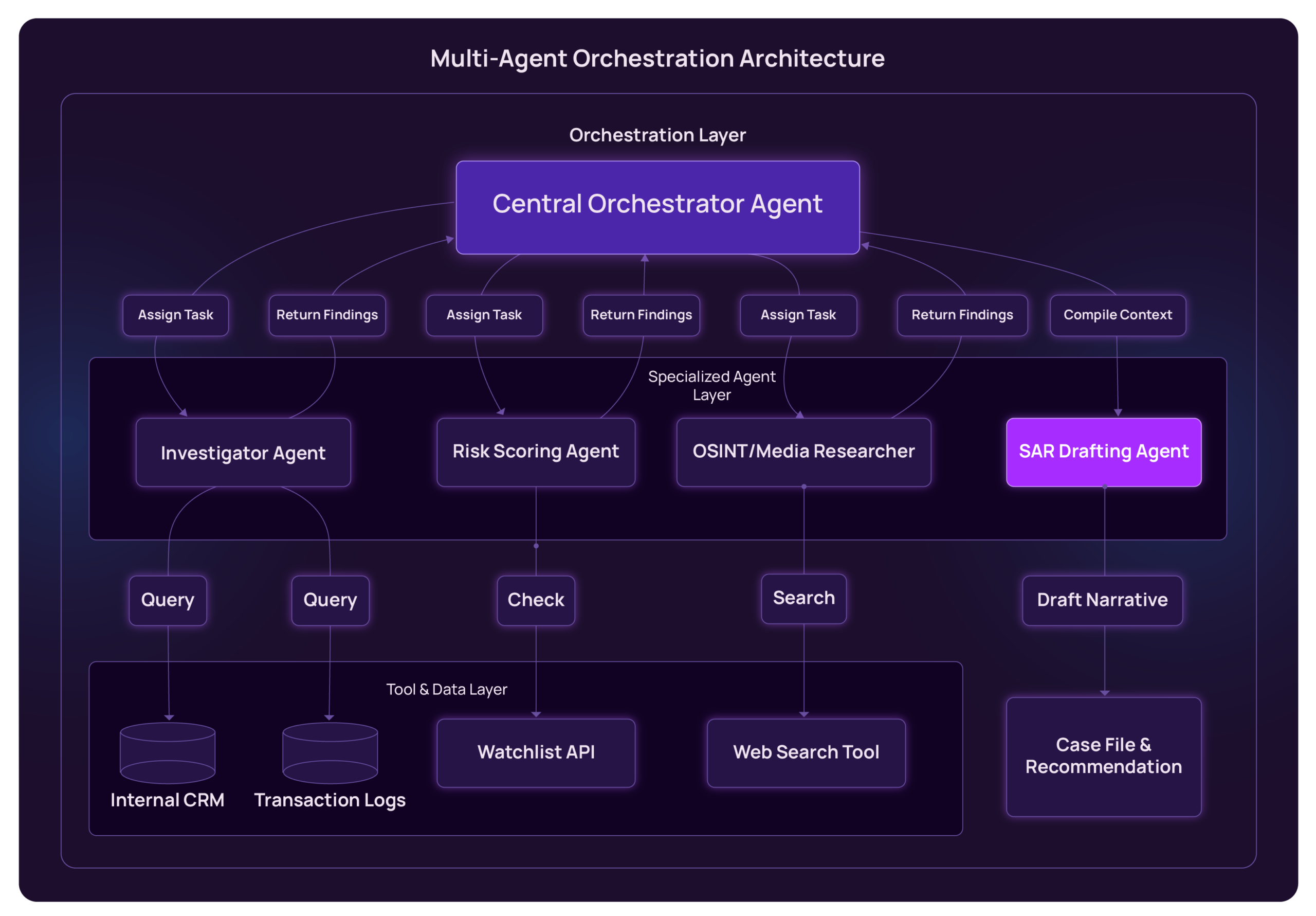

Multi-Agent Orchestration Architecture

For enterprise deployment, use a Multi-Agent System (MAS):

How U.S. Regulators Are Shaping Responsible AI in AML and KYC

A common misconception is that regulators oppose AI. In reality, US regulators are providing a roadmap for its use. The key is Governance.

1. FinCEN & The AML Act of 2020 (Modernization)

Status: Active & Evolving (2024-2026). In June 2024, FinCEN issued a Notice of Proposed Rulemaking (NPRM) that explicitly encourages innovation. The mandate is clear: institutions must conduct AI-focused risk assessments.

Actionable Insight: AI systems must be able to explain why it flagged (or didn’t flag) a customer. “The model said so” is not a valid defense. Documenting the model’s decision-making logic is a must.

2. NYDFS Part 500 (AI Cybersecurity Guidance)

Status: Released October 16, 2024, the NYDFS guidance clarifies that AI risks are cybersecurity risks.

Actionable Insight: Covered entities must assess risks like data poisoning (manipulating training data to bypass checks) and model inversion (extracting sensitive data from the model). KYC automation strategies must include robust “Red Teaming” of AI models.

3. OCC Model Risk Management (2025 Updates)

Status: Released October 2025, the OCC has expanded examination scopes to include AI model risk management.

Actionable Insight: Banks must implement Continuous Validation. Unlike static rules updated annually, AI models drift. Enterprises need “Challenger Models” running in the background to constantly benchmark production agents against new fraud typologies.

Operational Guardrails for Agentic AI in AML and KYC

How do you deploy Agentic AI without keeping your General Counsel awake at night? You implement a RAG (Retrieval-Augmented Generation) pipeline with strict guardrails.

The RAG Advantage for Compliance

Standard LLMs hallucinate. They might invent a sanction that doesn’t exist. RAG solves this by forcing the AI to “cite its sources.”

- Retrieval: The agent retrieves specific documents (e.g., the latest OFAC list, the customer’s specific utility bill).

- Augmentation: The agent is instructed: “Answer ONLY using the retrieved documents. If the answer is not there, state that you do not know.”

- Generation: The agent generates the response with inline citations (e.g., “Customer is low risk because [Document A] shows valid proof of address”).

Technical Guardrails for Hallucination Control

To ensure compliance risk is minimized, implement these layers of defense:

| Guardrail Layer | Technical Implementation | Purpose |

|---|---|---|

| Input Sanitization | Regex & Semantic Filters | Block jailbreak attempts or irrelevant prompts before they reach the agent. |

| Provenance Check | Citation-Verification Module | Ensure every claim in the SAR narrative is backed by a retrieved document ID. |

| Deterministic Fallback | Confidence Thresholds | If the AI's confidence score is <90%, route the case to a human analyst automatically. |

| Output Validation | Rule-Based Logic | Check the final output against hard rules (e.g., "Never approve a transaction from North Korea"). |

Source: Technical review of LLM guardrails in banking.

The Path Forward for AML and KYC Transformation

The era of “swivel-chair compliance,” where analysts manually copy-paste data between systems is ending. To scale effectively, enterprises must embrace KYC automation and Agentic AI.

By shifting from static rules to dynamic, intelligent agents, enterprises can achieve the “Holy Grail” of compliance:

- Cost Reduction: 50% lower operational costs.

- Risk Reduction: Higher accuracy and consistency than human teams.

- Regulatory Alignment: Systems that are auditable, explainable, and 2026-ready.

It’s time to move beyond manual compliance. AppsTek Corp helps financial institutions deploy Agentic AI for scalable, well-governed AML and KYC automation. Engage with our experts to see how this model fits your environment.

About The Author

Wanpherlin M. Shangpliang is a Marketing Manager at AppsTek Corp, driving strategic marketing initiatives across digital, content, and brand communications. She focuses on positioning AppsTek’s AI offerings and comprehensive digital engineering services while supporting market outreach across key industries. With expertise in campaign management, content strategy, and audience engagement, Wanpherlin builds effective marketing programs that drive measurable growth and strengthen AppsTek’s overall presence.