Mortgage processes still take 38 to 42 days on average, the same timeline as 2018. The delays are not caused by a lack of technology, as most modern mortgage lenders already have sufficient technological infrastructure in place.

The problem, however, lies with complexity: multiple handoffs, hundreds of document types, 236 fields on the Uniform Residential Loan Application, and dependencies on third-party vendors at every stage.

AI mortgage origination and underwriting through agentic systems changes this by orchestrating the entire workflow, not merely automating isolated tasks.

Agentic AI differs from basic automation because it makes autonomous decisions aligned with business rules rather than waiting for prompts. It follows an iterative cycle: sense the environment, plan the next action, execute, then reason from the results.

Where traditional automation follows preset rules, AI agents for origination and underwriting adapt based on outcomes and continuously learn from every transaction.

AI Agents in Mortgage Origination

The average cost to originate a loan exceeds $11,000. AI agents transform this by orchestrating activities across origination, processing, and closing stages.

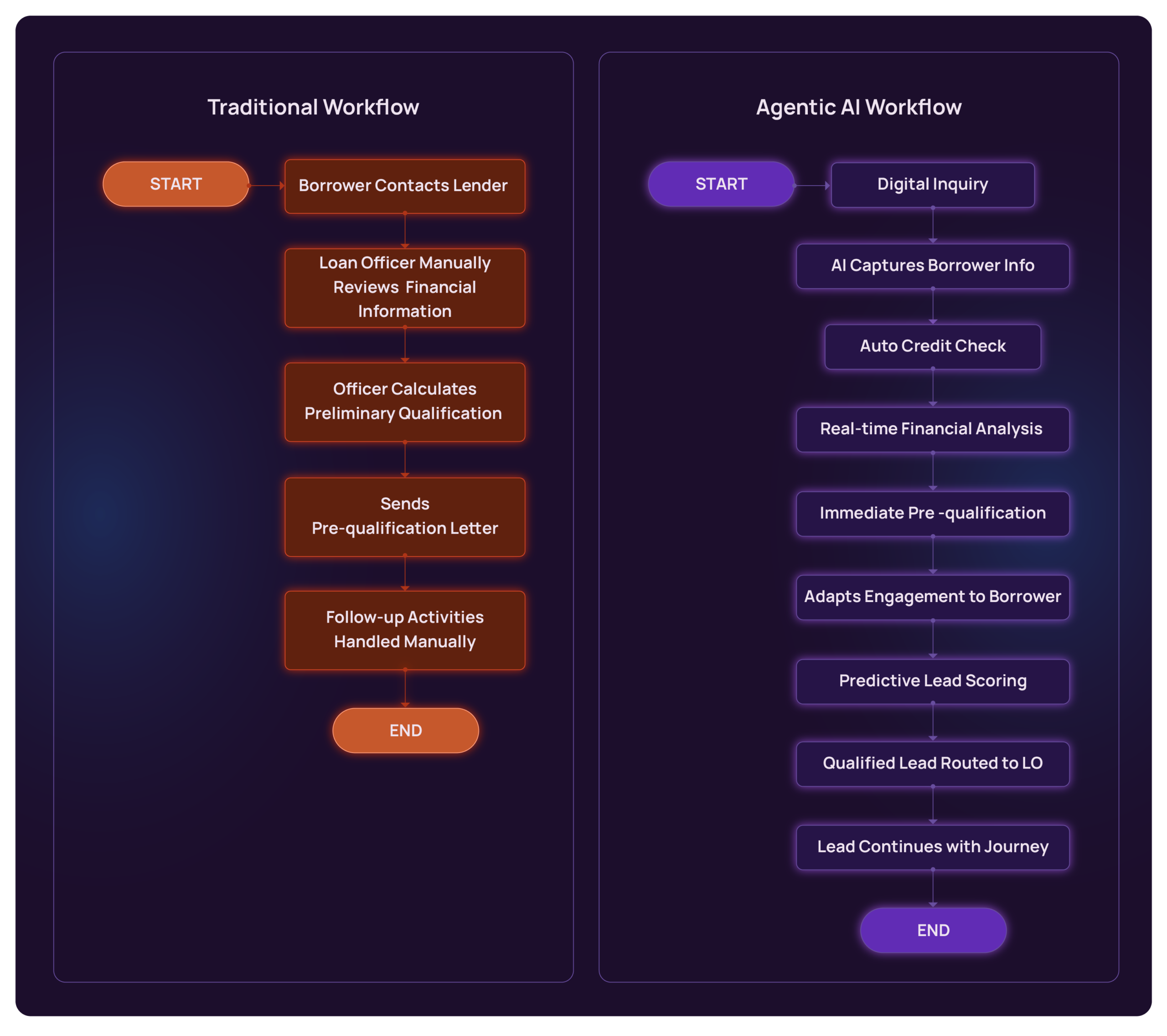

Pre-Qualification and Lead Management

Pre-qualification represents the first borrower-lender touchpoint yet remains inefficient. Loan officers manually gather financial information through phone calls and perform calculations using spreadsheets. Only half of pre-approvals convert to actual loans, largely because engagement drops off during manual follow-up.

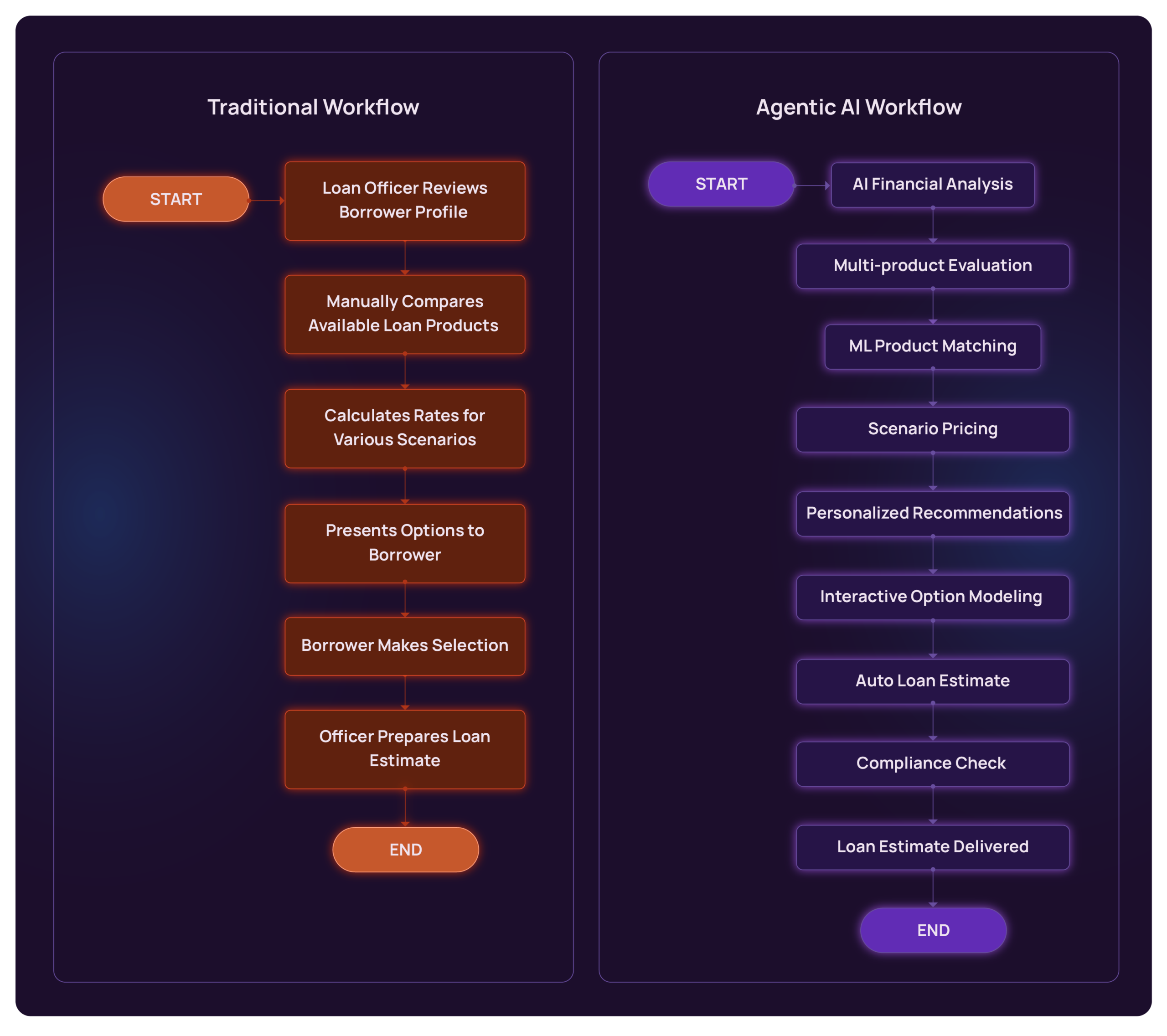

Loan Product Selection and Pricing

Selecting the optimal loan product requires evaluating dozens of variables: borrower credit profile, debt-to-income ratios, down payment amount, and property type. Traditional loan officers compare products manually and present options through static documents that become outdated as rates fluctuate.

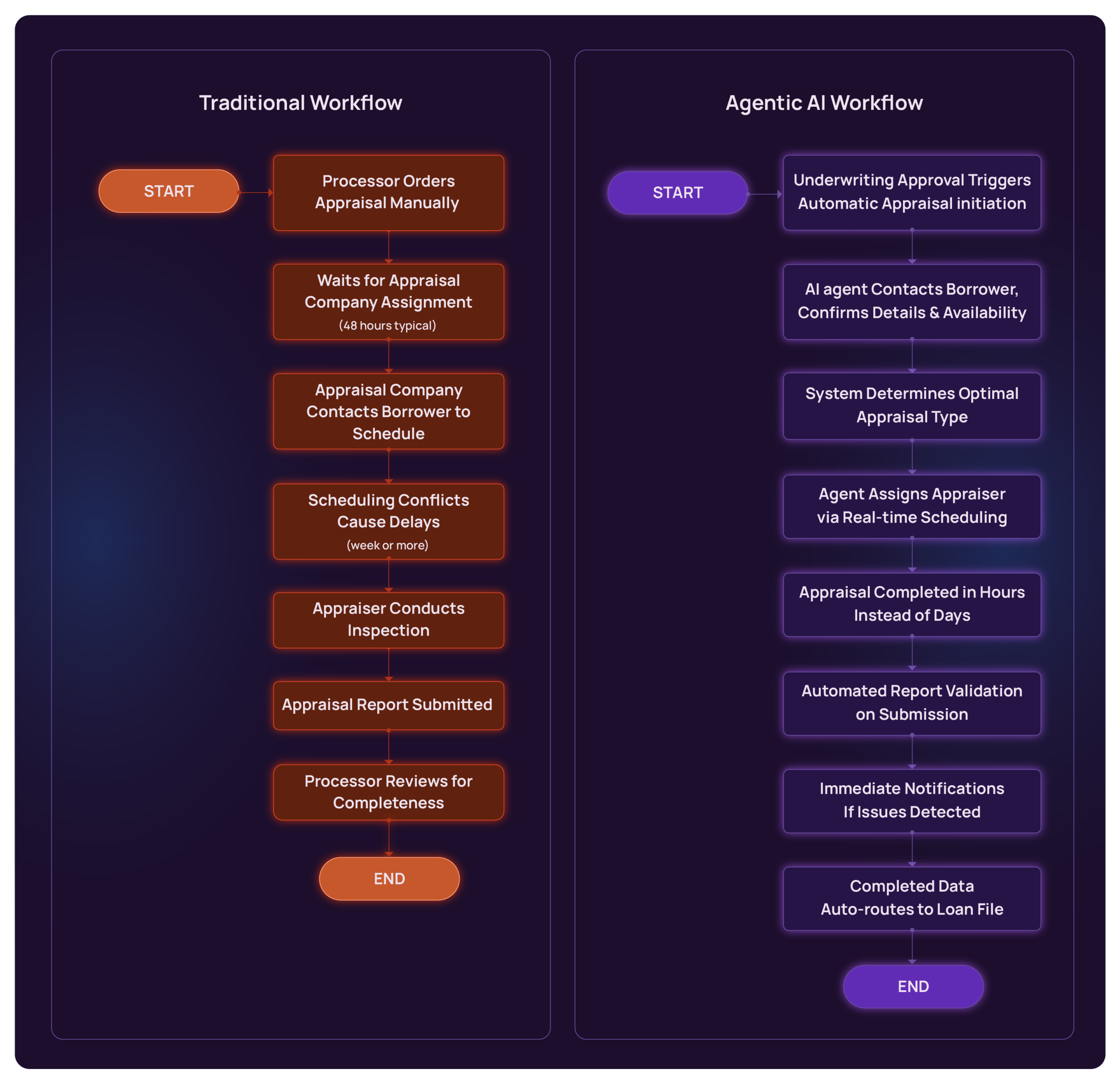

Appraisal Coordination and Property Valuation

Appraisal scheduling represents one of the most notorious delays in mortgage origination. Current workflows require processors to manually order appraisals, wait 48 hours for assignment, then coordinate scheduling between appraisers and borrowers. The process typically consumes a week or more.

Now that the file is created and core data gathered, here’s how agentic AI transforms the underwriting lifecycle.

The Five-Stage Workflow: Where Loan Underwriting AI Agents Take Control

AI mortgage underwriting turns disconnected manual steps into a continuous, coordinated workflow. It guides data capture, validates documents in real time, reconciles discrepancies, and routes exceptions automatically, so loan files move forward complete and decision-ready instead of stuck in rework.

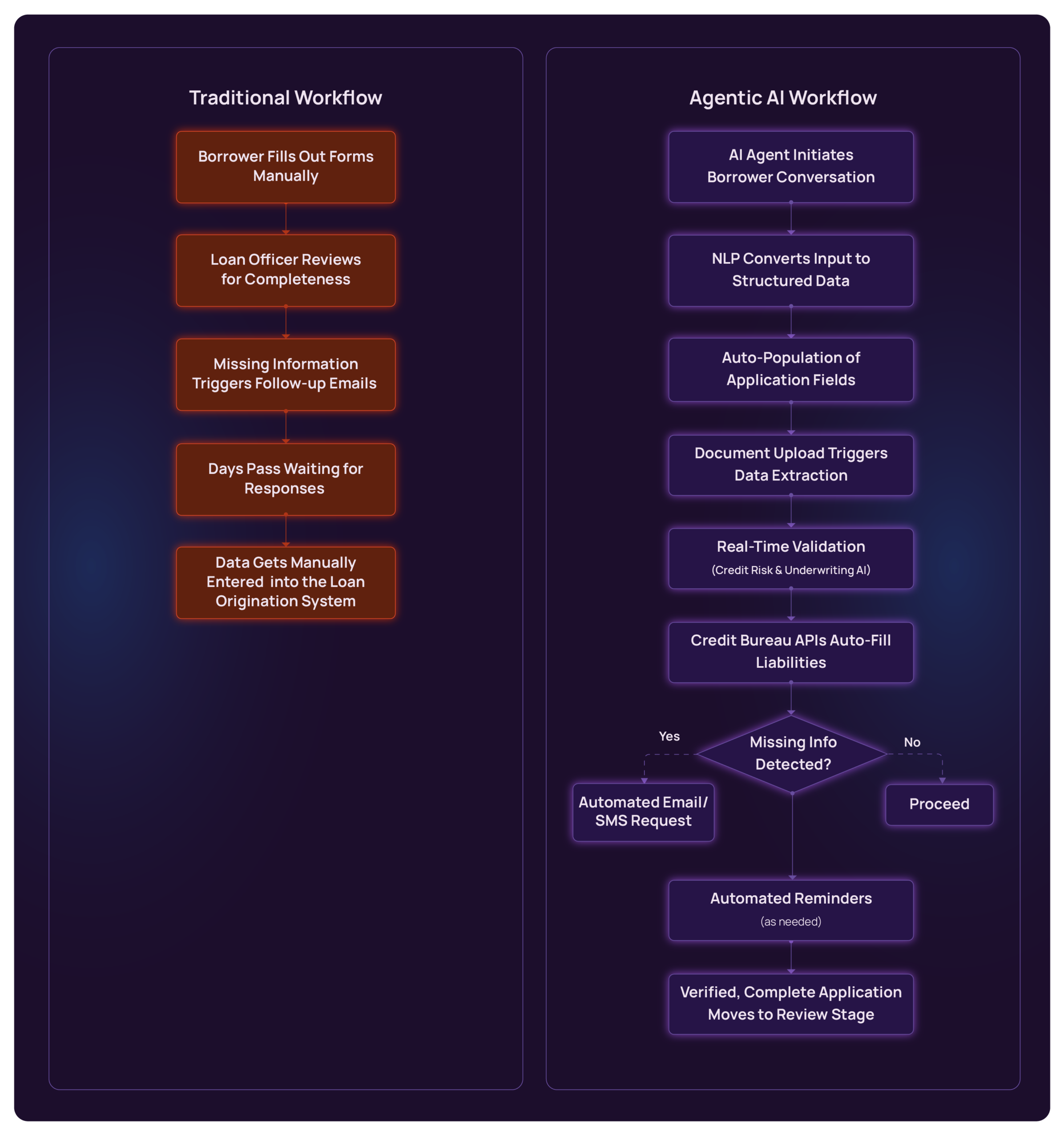

Stage 1: Application Capture and Initial Data Collection

The Uniform Residential Loan Application requires 236 fields of information from borrowers: employment history, income sources, asset details, liabilities, property information. First-time buyers abandon applications at this stage because the complexity overwhelms them.

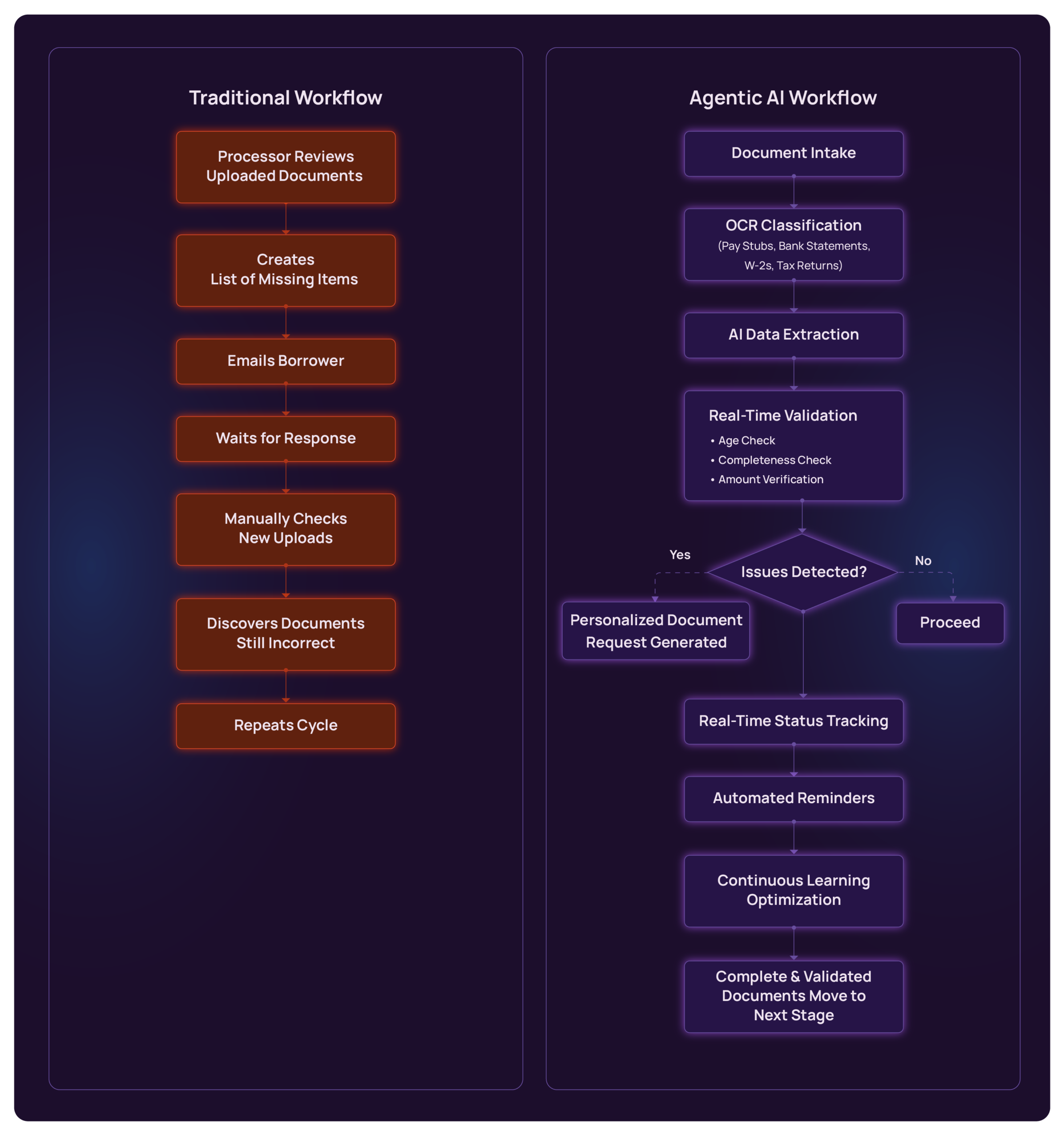

Stage 2: Document Collection and Intelligent Processing

Over 31.8% of underwriters report they are unable to verify borrower assets or collateral, the most basic requirement for loan approval. Document collection creates the biggest bottleneck: incomplete submissions, outdated pay stubs, illegible tax returns, missing employment letters.

The system identifies that March bank statements show a $15,000 deposit on the 12th and automatically generates: “Please provide documentation explaining the source of these funds.” This specificity eliminates ambiguity and reduces back-and-forth communication.

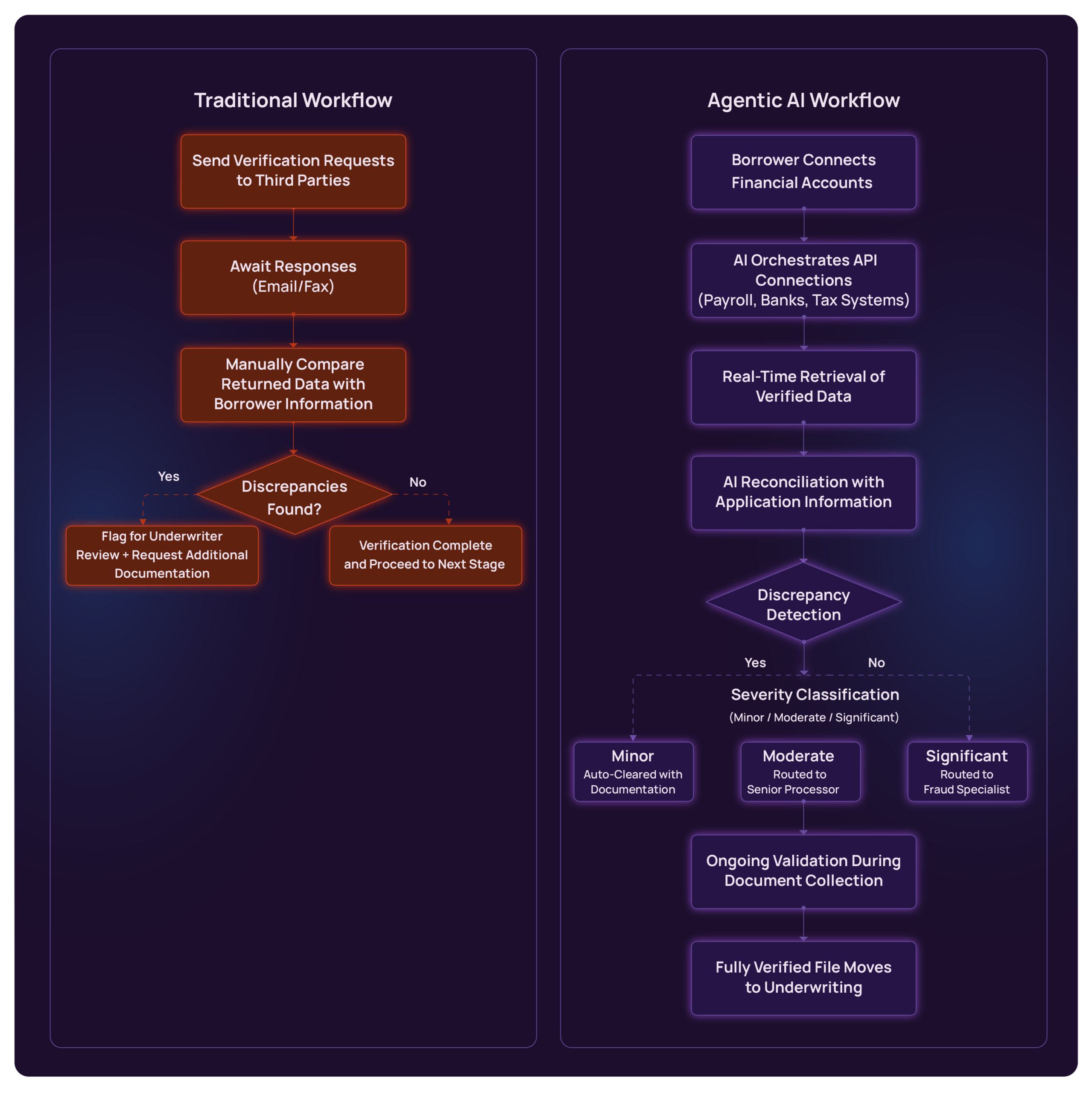

Stage 3: Third-Party Verification and Data Reconciliation

Income, employment, and asset verification traditionally require contacting multiple external parties through manual channels. Each connection point introduces delays and potential errors.

For instance, if the 1003 form shows income of $75,000 but verified payroll data shows $72,000, the system flags this discrepancy, attaches documentation showing both figures, and routes according to predefined business rules.

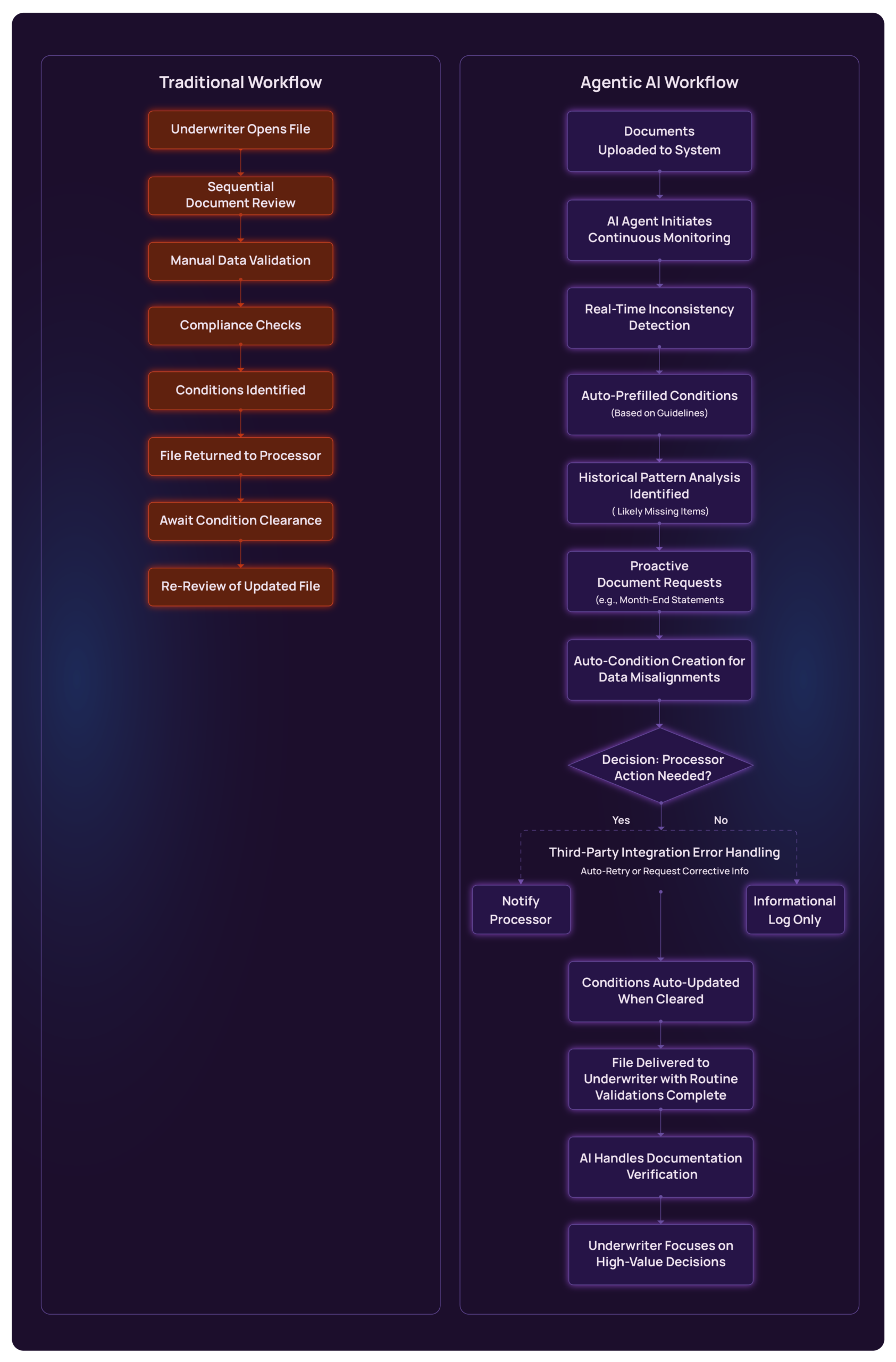

Stage 4: Underwriting and Conditional Approval

Automated underwriting systems like Fannie Mae’s Desktop Underwriter render instant findings, but human underwriters must validate data, documents, and compliance for final approval. This step consumes the most time in traditional workflows.

Processing times that normally require weeks compress to days as underwriters focus exclusively on complex decision-making rather than routine data validation.

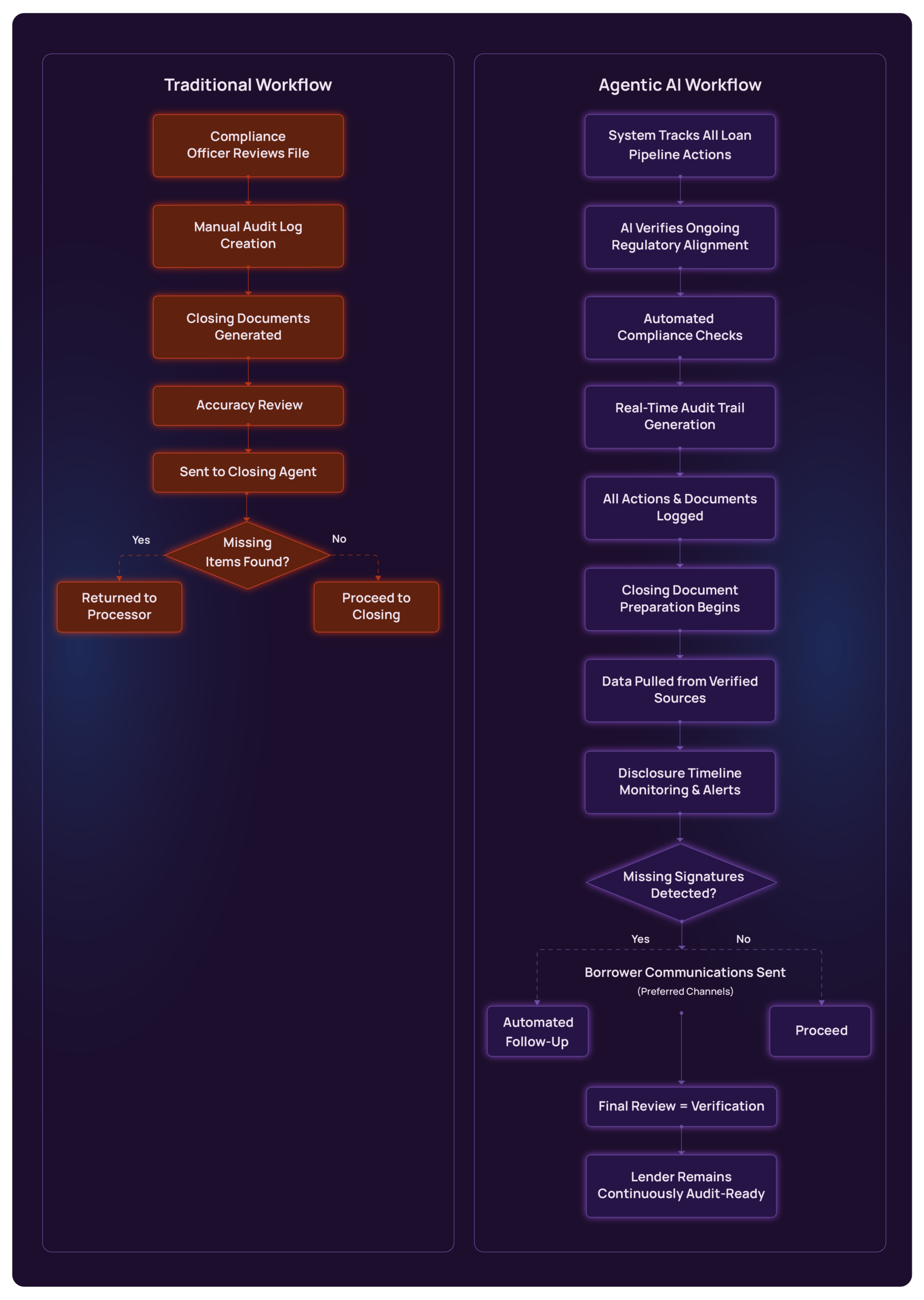

Stage 5: Final Compliance Review and Closing Preparation

Even after credit approval, final compliance checks and closing document preparation create delays. Regulatory requirements demand verification that every step followed proper procedures.

The compliance trail builds automatically as the loan progresses, eliminating the need for dedicated review cycles at the end of the process.

Benefits of AI in Mortgage Origination and Underwriting

Lenders report 30-50% reductions in operational expenses after implementing AI loan origination systems and AI underwriting systems. Document verification times drop from 48 hours to under 4 hours, a 92% improvement. Processing that once required 30-45 days now completes in as little as 8 minutes for qualified applications.

When lenders can process 2-3 times more loans per underwriter, volume spikes do not require proportional hiring. Underwriting transformation enables lenders to scale operations without scaling overhead proportionally.

AI-driven risk assessment has reduced mortgage default rates by 27% because machine learning algorithms do not miss patterns that human reviewers overlook after processing dozens of files. Fraud detection improves as the system learns new schemes across the entire loan portfolio.

How Agentic AI Automates Workflows Without Replacing Platforms

Agentic AI does not replace systems like Desktop Underwriter or Loan Product Advisor. It augments them by automating document collection, prevalidating inputs, and triaging exceptions before underwriting. Most lenders operate third-party loan origination platforms that cannot be replaced overnight.

The practical implementation approach focuses on three areas:

- Orchestrate internally: Deploy agents on top of existing LOS platforms to enhance workflows rather than replace them. The agent layer coordinates between systems currently in operation.

- Coordinate externally: Use APIs to connect orchestrators with external partners: closing agents, appraisers, title companies. The agent manages handoffs outside direct organizational control.

- Design for partial autonomy: Allow AI agents to handle end-to-end tasks where possible, but recognize when human oversight is required. Define clear boundaries for automated decisions versus manual review.

Security requires guardrails at every step. Human approvals remain necessary for high-risk actions or access to sensitive information. The implementation must maintain compliance with regulatory requirements while enabling autonomous operation within defined parameters.

What Lenders Should Do Now

Mortgage lending is not limited by a lack of systems, but by the coordination work between them, where document follow-ups, third-party verifications, data checks, and compliance steps create repeated handoffs that stretch timelines. The opportunity now is to make document collection, validation, reconciliation, condition management, and compliance tracking part of the workflow itself rather than separate manual efforts.

The approach outlined in the blog starts with high-volume areas like application data capture and document intake, then extends into verification orchestration, exception routing, and continuous file monitoring, so underwriters receive structured, reconciled files and can focus on credit decisions instead of rechecking information. Compliance is built in through automated audit trails and ongoing checks as the loan progresses.

Agentic AI works as a layer on top of existing LOS and underwriting systems, coordinating internal tools and external partners while maintaining human oversight and regulatory guardrails.

AppsTek Corp helps lenders implement this orchestration layer from origination through closing. Schedule a consultation with AppsTek Corp team today:

About The Author

Myrlysa I. H. Kharkongor is Senior Content Marketer at AppsTek Corp, driving content strategy for the company’s digital engineering services to enhance brand presence and credibility. With experience in media, publishing, and technology, she applies a structured, insight-driven approach to storytelling. She distills AppsTek’s cloud, data, AI, and application capabilities into clear, accessible communications that support positioning and grow the brand’s digital footprint.