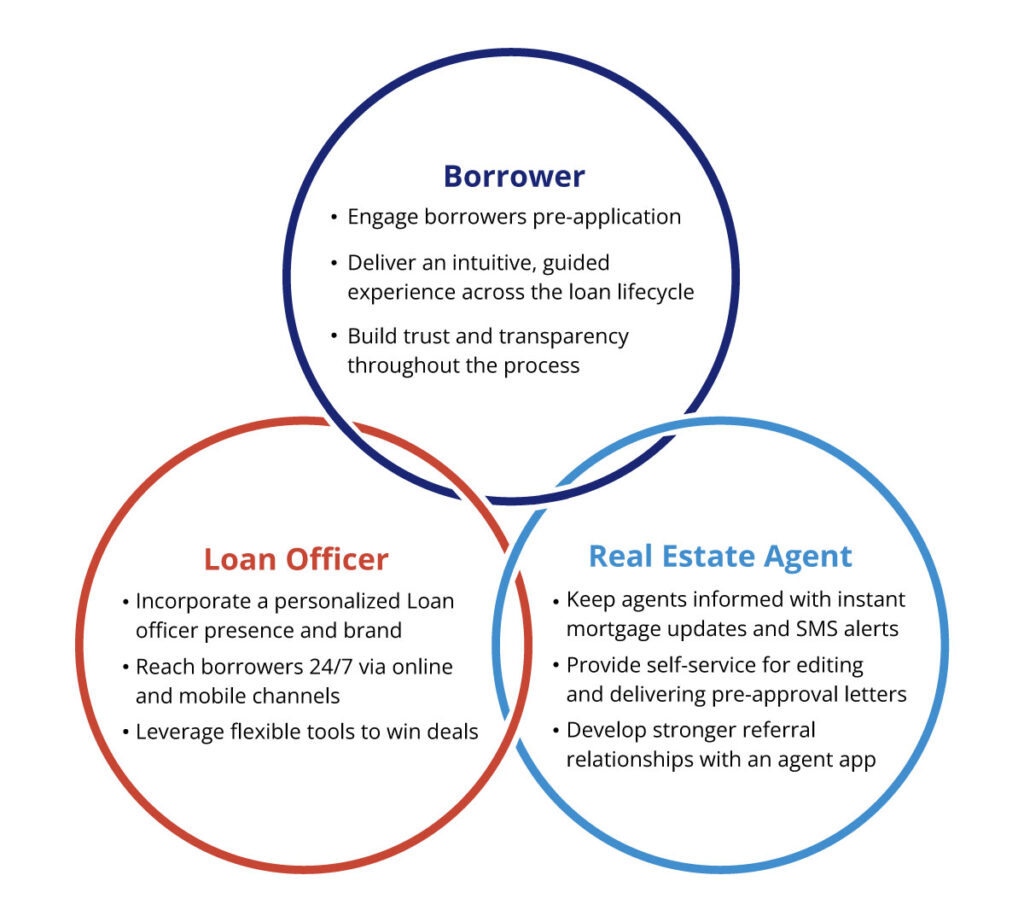

The mortgage industry is a complex ecosystem, with a delicate balance between loan officers (LOs), real estate agents, and borrowers. Each player plays a crucial role, and their success is intertwined. While the focus often lies on individual performance, the harmonious collaboration between these three groups truly drives growth and lasting success.

The relationship between Loan Officers (LOs), real estate agents, and borrowers is symbiotic. A satisfied borrower who feels confident and well-supported throughout the mortgage process is more likely to recommend the loan officer to their network, creating valuable referrals for both the loan officer and the agent. This positive feedback loop fuels a thriving ecosystem where everyone benefits from a shared commitment to excellence.

Enhancing Stakeholder Relationships Through Technological Integration

The modern borrower expects a streamlined and efficient mortgage experience, blending the convenience of digital mortgage platforms with the personalized guidance of a seasoned professional. This is where technology emerges as a powerful tool, enabling Loan Officers to bridge the gap between digital convenience and human connection.

Leveraging Technology to Build Trust and Relationships

The right mortgage technology stack can transform how loan officers interact with borrowers and agents, fostering trust and building strong relationships at every stage of the mortgage journey. Here’s how:

- Enhanced Transparency and Collaboration: Mortgage loan origination software allowing real-time communication, document sharing, and progress updates create a transparent and collaborative environment. Borrowers feel empowered with access to information, while agents appreciate the ability to stay informed about their clients’ loan status.

- Personalized Experiences: Tailoring mortgage communication and information delivery to individual borrower preferences fosters a sense of care and understanding. This personalized approach strengthens the borrower-loan officer relationship, increasing satisfaction and loyalty.

- Streamlined Processes: Mortgage automation tools streamline repetitive tasks, freeing up loan officers to focus on building relationships and providing personalized guidance. This efficiency translates to a smoother experience for both borrowers and agents.

- Early Engagement and Purchase Affordability: Features like soft credit qualification and loan scenario simulators allow borrowers to explore their options early in the process, empowering them to make informed decisions. This proactive approach can be particularly valuable in challenging markets, where borrowers may be on longer buyer journeys.

- Maintaining Engagement: Automated mortgage follow-ups and personalized communication options ensure consistent engagement throughout the mortgage process, regardless of the borrower’s comfort level with technology. This proactive communication fosters a sense of care and keeps both borrowers and agents informed.

The Power of a Unified Mortgage Platform

The ideal mortgage technology stack integrates all mortgage communication channels, allowing LOs, borrowers, and agents to easily connect and collaborate within a single platform. This eliminates confusion, reduces response times, and ensures everyone stays organized and informed.

Delivering a Superior Experience: The Key to Success

The technology loan officers choose to implement can make a significant difference in their ability to deliver on their promises and create a positive experience for borrowers and agents. Loan officers can ensure a smooth and efficient mortgage journey for everyone involved by leveraging automation to streamline processes and provide real-time mortgage support.

Building a Thriving Ecosystem: The Benefits of Collaboration

The success of any loan officer is directly tied to the strength of their relationships with borrowers and agents. By providing exceptional value through personalized service, efficient processes, and a commitment to transparency, loan officers can cultivate a loyal customer base and attract valuable referrals. This mutually beneficial ecosystem ensures continued success for everyone involved.

The Future of Mortgage: Embracing Technology and Building Relationships

The mortgage industry constantly evolves, with new technologies and market conditions shifting. However, the core principles of building strong relationships and providing exceptional service remain constant. By embracing technology and prioritizing customer experience, loan officers can navigate the ever-changing landscape and create a thriving ecosystem that benefits everyone involved.

To learn more about how AppsTek Corp helps lending companies build AI and automation-driven digital lending platforms, establishing a mutually beneficial relationship between Loan Officers, Real Estate Agents, and Borrowers, get in touch with our experts.

Modernize Mortgage Experiences NOW!

About The Author

Wanpherlin M. Shangpliang is a Marketing Manager at AppsTek Corp, driving strategic marketing initiatives across digital, content, and brand communications. She focuses on positioning AppsTek’s AI offerings and comprehensive digital engineering services while supporting market outreach across key industries. With expertise in campaign management, content strategy, and audience engagement, Wanpherlin builds effective marketing programs that drive measurable growth and strengthen AppsTek’s overall presence.