Financial data management can be an arduous challenge for companies of any size. From tracking transactions to evaluating performance, this essential asset can play a pivotal role in decision-making and regulatory compliance processes. Yet traditional methods often fall short in terms of scalability, agility, and security.

Snowflake, a cloud-based data platform, presents an innovative solution to financial data management and governance. Through its advanced features and distinctive architecture, it enables organizations to streamline data processes while increasing data quality and governance efficiencies. We will explore some of its many advantages as a financial data management and governance solution and how Snowflake revolutionizes how businesses handle financial information.

Challenges Faced By The Financial Services Industry In Managing And Governing Data

Financial services institutions face numerous difficulties when it comes to data management. With the increasing volume, variety, and velocity of information flowing their way, banks struggle to effectively utilize and exploit their information assets. Some examples include:

- Data Security: Financial institutions entrusted with sensitive customer information place great emphasis on safeguarding it against threats such as cyber-attacks and data breaches, making customer security one of their greatest challenges.

- Data Governance: Financial services must comply with stringent regulatory requirements and compliance standards that include adhering to data accuracy, consistency and integrity standards while upholding proper access controls on sensitive customer information.

- Data Silos: Financial institutions often utilize multiple data sources and systems that do not share data, leading to data silos that prevent an integrated view of customer information as well as analysis and decision-making processes. This fragmentation makes gaining a holistic picture difficult while inhibiting data analysis processes and decision-making procedures.

- Data Quality: Financial institutions rely heavily on accurate and reliable data. However, incomplete or inaccurate data can hinder the decision-making process and cause costly errors; maintaining this quality across systems and sources presents significant difficulties.

- Data Integration: Financial institutions often operate using legacy systems not compatible with modern data technologies, making consolidation and integration challenging and hampering customer views of all of their customer information.

- Scalability: Financial services industry data management systems need to accommodate an immense volume and variety of information; traditional approaches often fail to do this effectively, making scalability an obstacle when storing, processing and analyzing large volumes in real-time.

Snowflake can help the financial services industry meet the challenges associated with data management and governance more easily. Snowflake provides a secure, scalable, integrated platform that equips financial institutions to efficiently utilize and utilize their data assets – leading to enhanced decision-making capability as well as improved customer experiences.

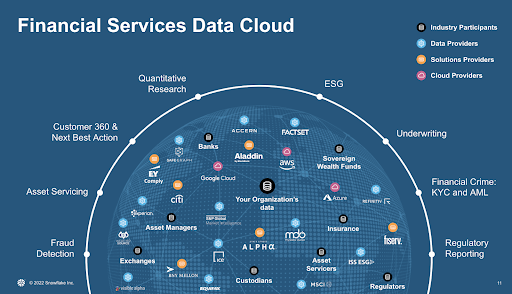

Overview Of Snowflake’s Financial Services Data Cloud And Its Benefits

Snowflake is an innovative cloud-based data platform that equips financial services organizations with an efficient, flexible solution for managing and analyzing their data. Their Financial Services Data Cloud features tools designed specifically to address the unique requirements of financial services. Organizations using Snowflake can securely store, process and analyze their information in real-time to enable faster decision-making based on data analytics – see here to discover its many advantages! Take a look at its features now:

- Scalability: Snowflake’s cloud-based architecture allows financial services organizations to easily scale up data storage and processing capacity as their needs change without incurring costly infrastructure investments for this expansion. With Snowflake, companies can efficiently handle rising volumes of data with its dynamic approach without incurring unnecessary expenses in terms of storage or processing capabilities.

- Security: Snowflake prioritizes data security and compliance by offering rigorous encryption and access controls to safeguard sensitive financial data. Their platform’s secure foundation gives organizations peace of mind knowing their data remains protected against unwarranted access by third parties.

- Real-Time Analytics: Snowflake’s Financial Services Data Cloud allows organizations to analyze their data in real-time for immediate insights into market trends, customer behavior and risk management – giving organizations an edge in an industry as dynamic as financial services. By harnessing real-time analytics capabilities, organizations gain faster and more informed decision-making within this fast-paced financial landscape.

- Collaboration: Snowflake provides seamless team collaboration within financial services organizations. Multiple users can simultaneously access and analyze data on Snowflake for faster decision-making processes and cross-functional collaboration.

- Cost Effective: Snowflake’s pay-as-you-go pricing model offers organizations an efficient means of optimizing data storage and analytics costs without incurring upfront infrastructure investments or having to scale usage according to needs, providing cost and resource optimization at every turn.

Use Case: Snowflake’s Financial Services Data Cloud has proven beneficial for financial services organizations through its risk management features. Leveraging the real-time analytics and scalability capabilities of Snowflake allowed one bank to constantly analyze market data, customer transactions and external factors – helping it identify potential threats while meeting regulatory compliance. As a result, customers were better protected while regulatory compliance remained intact – ultimately protecting the assets of customers at every turn.

4. Key Features And Functionalities Of Snowflake For Financial Data Management And Governance

| Features | Functionalities |

|---|---|

| 1. Data Warehousing Solution | Snowflake offers an online data warehouse platform designed to allow financial institutions to store and organize large volumes of structured and semi-structured financial data efficiently and safely. |

| 2. Scalability | Snowflake provides an elastic and scalable architecture capable of meeting the changing data needs of financial organizations, including dynamic scaling resources up or down, depending on demand for optimal performance at all times. |

| 3. Data Security | Snowflake takes security seriously, offering robust features such as encryption at rest and transit, role-based access controls and data masking to protect sensitive financial data from unwarranted access. |

| 4. Data Governance | Snowflake provides features to aid financial institutions with data governance, such as lineage tracking, cataloging and metadata management. These functions allow institutions to track the origin, quality and usage of financial data within an institution’s account. |

| 5. Data Integration | Snowflake provides effortless data integration services, making it possible for financial organizations to easily collect and integrate data from diverse sources – transactional systems, market data providers and external feeds alike. |

| 6. Data Transformations | Snowflake provides built-in support for data transformation, enabling financial institutions to perform complex transformations, aggregations and calculations within its platform for their financial data. |

| 7. Query Performance | Snowflake’s unique architecture of separate storage and computing ensures fast and efficient query performance for financial organizations that utilize large datasets without experiencing performance bottlenecks or experiencing performance bottlenecks in running complex queries on them. |

| 8. Time Travel | Snowflake’s Time Travel feature gives financial institutions access to previous versions of their data for analysis, tracking changes and performing audits on it. This functionality enables financial institutions to better monitor trends, track shifts, and perform audits on financial records. |

| 9. Cost Optimization | Snowflake provides cost optimization features like automatic query optimization, workload management and resource utilization monitoring to assist financial organizations with optimizing their data processing costs. |

| 10. Data Sharing and Collaboration | Snowflake allows financial institutions to easily collaborate on data with both internal teams and external stakeholders by offering secure data-sharing capabilities with granular access controls that ensure data privacy and compliance. |

Final Thoughts

So, this shows how Snowflake holds great promise within the financial services sector. Boasting sophisticated data management and governance capabilities, this technology provides a secure yet scalable platform to securely handle financial data. This attribute makes Snowflake especially suitable for industries that deal with sensitive information while adhering to strict compliance regulations.

Overall, Snowflake will play an instrumental role in shaping the future of financial services by equipping organizations with the tools and capabilities necessary to thrive in an increasingly data-centric environment. If you desire to know more about it, do not hesitate and connect with the experts at AppsTek Corp now.