Table of Contents

- Why Rule-Based Automation Fails at Scale and How Agentic AI Is Replacing It

- What Is Automation Sprawl and Why Does It Increase Risk in Financial Institutions?

- Why Adding More Automation Tools Cannot Solve Structural Banking Limitations

- How Agentic AI Enables Scalable Automation in Banking

- Three Strategic Approaches to Implementing Agentic AI

- What Changes When Banks Shift from Tools to Agentic Architecture?

- Why the Future of Banking and Mortgage Automation Is an Architectural Choice

Why Rule-Based Automation Fails at Scale and How Agentic AI Is Replacing It

Rule-based automation fails at scale in financial institutions because exceptions cannot be fully predefined. As banks encounter new borrower profiles, regulatory changes, and shifting market conditions, the default response is to deploy additional specialized automation tools.

Over time, this creates automation sprawl, increasing integration complexity, maintenance costs, and operational risk rather than improving outcomes.

Agentic AI in banking offers a fundamentally different approach. Instead of layering tools to address individual gaps, agentic systems apply contextual reasoning and continuous learning, enabling institutions to handle novel cases without proliferating brittle automation layers.

This article is for banking and mortgage leaders evaluating why RPA programs stall at scale and what replaces them.

The Default Response to Automation Gaps

When rule-based automation encounters exceptions, the instinctive response is predictable: deploy another specialized tool. A bot for document classification fails on non-standard forms? Add an OCR enhancement tool. The underwriting system cannot handle irregular income? Deploy a supplementary calculation engine. AML monitoring generates excessive false positives? Layer on another rules engine with more sophisticated thresholds.

This approach appears logical. RPA deployments have reached 30-36% of global BFSI operations, delivering 60% processing time reductions for routine tasks. When gaps emerge, the established practice is to fill them with additional automation.

The result is not improved performance but automation sprawl: increasingly complex tool ecosystems where each specialized solution creates new integration points, maintenance burdens, and failure modes.

Industry data reveals net losses per mortgage file increased from $82 to over $2,800 in two quarters, driven by the compounding costs of managing proliferating automation layers rather than addressing architectural limitations.

What Is Automation Sprawl and Why Does It Increase Risk in Financial Institutions?

Automation sprawl in banking emerges when institutions respond to rule-based automation failures by adding specialized tools for each exception.

While this approach appears to increase coverage, it steadily fragments core workflows, creating hidden integration risk, rising maintenance overhead, and brittle decision paths. The following patterns show how this fragmentation compounds operational complexity instead of resolving it.

Pattern 1: How Specialized Automation Tools Create Integration Risk

Specialized bots increase system complexity because each new tool introduces additional integrations, maintenance paths, and failure points. A regional bank’s mortgage operations illustrate the progression. Initial RPA deployment automated standard income verification, reducing processing time from 60 to 12 minutes per file. When the system failed on self-employed borrowers, the response was predictable: deploy a specialized calculation engine for Schedule C processing. This created new problems:- The supplementary tool required separate maintenance

- System integrations introduced latency and failure points

- Core system changes triggered bot reconfiguration

- Exception routing fragmented across multiple bots

Pattern 2: Why Automation Maintenance Costs Multiply at Scale

Automation maintenance costs grow exponentially, not linearly, as tools are added, especially in regulated environments.

Each additional automation tool does not add linearly to maintenance requirements; it multiplies them. When regulatory requirements change (which they do constantly in mortgage process automation), the update must propagate through each specialized tool.

When legacy systems undergo patches, each integration point requires testing and potential reconfiguration. One major institution documented the effect of deploying five specialized RPA tools:

- Five separate vendor contracts

- Twelve integration points with core systems

- 23 distinct update cycles per regulatory change

- A 67% increase in IT support tickets compared to the pre-automation baseline

Diagnosing failures became a forensic exercise. Identifying which tool caused an issue often required hours of investigation.

The Wells Fargo mortgage modification crisis demonstrates the catastrophic risk: when calculation logic in automated systems failed for 625-870 borrowers over multiple years, the complexity of the tool ecosystem delayed error discovery. Approximately 400 families lost homes before the issue was identified and corrected, ultimately requiring $185 million in settlements.

The more tools deployed to “fix” automation gaps, the more opaque the system becomes, and the higher the risk that silent failures propagate undetected.

Pattern 3: Why Comprehensive Automation Coverage Is Impossible in Banking

Comprehensive automation coverage is impossible in regulated banking because exception patterns cannot be fully enumerated in advance.

Tool proliferation is driven by the belief that enough specialized solutions will eventually cover all scenarios. This assumption fails in judgment-intensive environments.

New borrower profiles, regulatory updates, and market conditions continuously generate cases that fall between predefined categories.

In AML compliance, this manifests as escalating alert volumes despite deploying multiple specialized rules engines. Analysts spend 90% of time investigating false positives generated by increasingly sophisticated but still rule-based detection tools.

Each new detection rule added to catch missed schemes generates its own false positives, compounding the problem. Rule-based systems cannot reason about cases they were not explicitly programmed to handle. Adding tools for known gaps leaves institutions equally vulnerable to unknown future exceptions.

Why Adding More Automation Tools Cannot Solve Structural Banking Limitations

Limitation 1: Why Rule-Based Automation Cannot Encode Judgment

Rule-based automation performs well when decisions follow deterministic logic. When income crosses a set threshold, credit scores meet minimum requirements, and debt-to-income ratios fall within limits, approval is straightforward. Judgment-intensive scenarios break this model:

- Self-employed borrowers with strong income growth but limited history

- Recent immigrants with strong assets but minimal domestic credit records

- Properties in markets with limited comparables

- Conflicting documentation sources

No number of specialized tools can codify contextual judgment. Each new exception produces another brittle rule set, while the most complex and valuable cases continue to require manual review.

Limitation 2: How Tool Integration Creates Compounding Failure Points

Each automation tool represents a potential failure point. Layered tools multiply those risks. Examples include:- Output format mismatches between tools

- Timeouts triggering cascade failures

- Conflicting results with no resolution logic

- Interface changes breaking integrations silently

Limitation 3: Why Specialized Automation Tools Prevent Learning at Scale

Specialized tools do not learn from operational outcomes. When new scenarios arise, they fail routing logic or are forced into inappropriate processing paths. Manual reviewers resolve the case, but the knowledge gained does not improve the system.

Each exception represents valuable institutional learning. In tool-proliferation architectures, that learning remains siloed instead of improving future decisions.

How Agentic AI Enables Scalable Automation in Banking

Agentic AI in banking refers to adaptive systems that apply contextual reasoning, learn continuously from operational outcomes, and handle novel cases without rule rewrites or specialized tool deployment.

Understanding Agent Complexity Levels

Agentic AI implementations vary widely in complexity, ranging from simple retrieval and search functions to fully autonomous agents managing complex workflows.

| Level | Agent Type | Capabilities | Banking Application |

|---|---|---|---|

| Level 1 | Search & Retrieval | Query databases, retrieve information | Document lookup, policy search |

| Level 2 | Insight Generation | Analyze data, generate reports | Risk analysis, compliance reporting |

| Level 3 | Task Automation | Execute defined workflows | Payment processing, KYC verification |

| Level 4 | Multi-Agent Coordination | Multiple agents collaborate | AML investigation, underwriting |

| Level 5 | Fully Autonomous | Independent decision-making | Dynamic treasury management, fraud response |

Currently, simpler agents (Levels 1-2) dominate deployments due to ease of implementation. Fully autonomous agents (Level 5) remain emerging, requiring customized solutions and process reengineering.

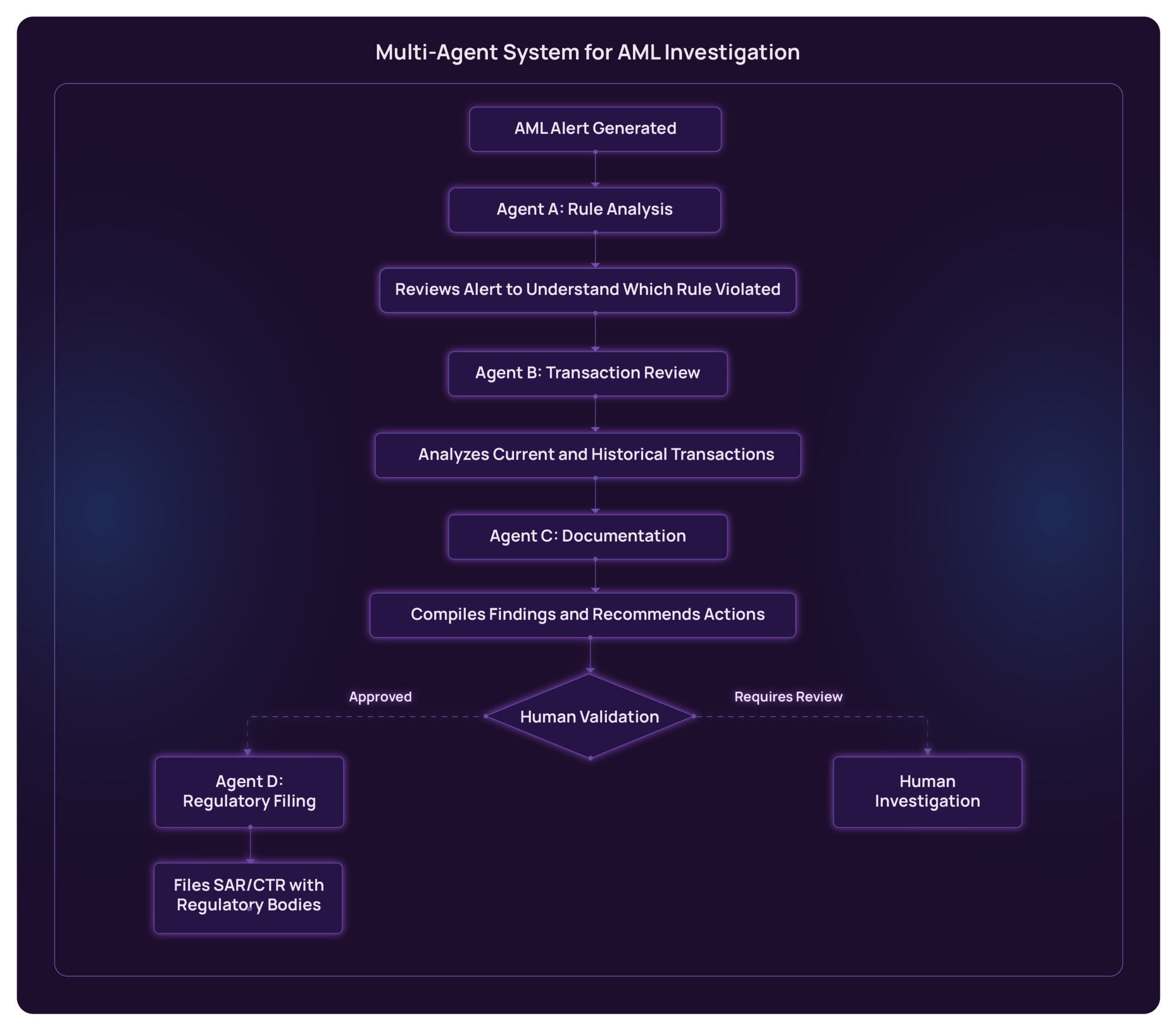

Multi-Agent Workflow Example: AML Investigation

A practical multi-agent system for AML investigation demonstrates how coordination replaces tool proliferation:

- Agents communicate autonomously until human validation required

- Each agent accesses necessary data independently using RAG and Model Context Protocol

- System reveals hidden patterns humans might miss

- Faster, more consistent than sequential tool processing

How Agentic AI Enables Scalable Automation in Banking and Mortgage

Agentic AI in banking refers to adaptive systems that apply contextual reasoning, learn continuously from operational outcomes, and handle novel cases without rule rewrites or specialized tool deployment.

Unified Reasoning Replaces Exception-Specific Tooling

Rather than deploying specialized tools for each exception type, agentic AI for banking implements unified systems that apply contextual reasoning. Industry implementations report:

- Processing 12,000 commercial credit agreements in seconds,

- 360,000 hours saved annually

- $1.5 billion in annual business value across 300+ use cases

Instead of encoding rules for every document variation, agentic systems apply natural language understanding to interpret context regardless of format. Novel cases are handled through learned patterns rather than new tool deployment.

Continuous Learning Replaces Perpetual Tool Addition

AI agents for banking improve from each exception rather than requiring new specialized tools. Leading implementations have processed over 3 billion client interactions (averaging 58 million monthly), continuously refining response quality without deploying specialized chatbot tools for each new query pattern.

Rather than relying on pattern matching, these systems understand intent contextually, eliminating the need for specialized tools for each new query type. Institutions report 20% developer efficiency gains and 50%+ reductions in IT help desk calls, demonstrating autonomous banking capabilities without the tool proliferation that characterizes rule-based approaches.

Reduced Integration Complexity, Lower Maintenance Burden

Replacing multiple specialized RPA tools with unified agentic systems eliminates integration complexity:- Single platform for document processing across all types (instead of specialized OCR tools for each format)

- Unified underwriting logic applying contextual reasoning (instead of separate engines for standard, self-employed, foreign national, portfolio exceptions)

- Integrated compliance monitoring adapting to pattern changes (instead of layered rules engines each catching specific schemes)

Three Strategic Approaches to Implementing Agentic AI

Banks can introduce agentic AI through three distinct approaches, each suited to different organizational contexts and maturity levels:

| Approach | What it is | How it works | Best for | Example |

|---|---|---|---|---|

| Smart Overlay | Create an intelligent conversational layer that operates atop existing systems without replacing underlying infrastructure. |

• AI agents sit on top of existing systems, integrating via APIs while following current SOPs. • Leverages existing RPA and workflows without replacing core infrastructure. |

• High-volume, repetitive processes needing near-term productivity gains. • Organizations seeking quick wins with minimal architectural change. |

Deploying an agent that elevates basic RPA-managed treasury cash sweeps into dynamic liquidity optimization with intelligent pricing and hedging decisions. |

| Agentic by Design | Build new autonomous applications from scratch, specifically architected for agentic capabilities. |

• Builds purpose-designed, microservice-style agentic applications. • Architected for autonomy, learning, and adaptability from the ground up. |

• Greenfield implementations or areas constrained by legacy systems. • Functions requiring intelligent decision-making at scale. |

Building specialized agentic services for fraud detection that independently analyze patterns, learn from outcomes, and adapt detection strategies without rule updates. |

| Process Redesign | Fundamentally reengineer entire workflows to optimize for agentic AI capabilities. |

• Re-engineers workflows end-to-end for agent-centric execution • Embeds intelligence across processes rather than at isolated steps. |

• Strategically critical, high-complexity workflows. • Organizations pursuing long-term competitive advantage through transformation. |

Completely reimagining mortgage underwriting to enable multi-agent collaboration across document analysis, income verification, risk assessment, and compliance validation. |

Choosing Your Approach

| Factor | Smart Overlay | Agentic by Design | Process Redesign |

|---|---|---|---|

| Implementation Speed | Fast (weeks–months) | Moderate (months) | Slow (quarters–years) |

| Investment Required | Low | Moderate | High |

| System Changes | Minimal | Moderate | Extensive |

| Risk Level | Low | Moderate | High |

| Transformation Depth | Surface | Substantial | Fundamental |

| Best for Maturity | Early stage | Intermediate | Advanced |

These approaches are not mutually exclusive. Financial institutions can deploy smart overlays for quick wins while simultaneously building agentic-by-design solutions and planning strategic process redesigns for the most critical workflows.

What Changes When Banks Shift from Tools to Agentic Architecture?

The core difference between tool proliferation and agentic architecture is that one multiplies complexity while the other centralizes reasoning and learning.

| Approach | Tool Proliferation (Current State) | Agentic Architecture (Target State) |

|---|---|---|

| Exception Handling | Deploy specialized tool for each type | Apply contextual reasoning across all cases |

| System Complexity | Compounds with each tool added | Unified platform reduces integration points |

| Maintenance | Linear increase per tool | Centralized model governance |

| Learning | Each tool remains static | Continuous improvement from operations |

| Cost Trajectory | Escalating (from $82 to $2,800/file) | Declining as system improves |

- Model risk management frameworks replacing tool-by-tool testing protocols

- Bias monitoring across decision types rather than per-tool audits

- Explainability standards ensuring regulatory compliance

- Human oversight protocols with clear escalation paths

Why the Future of Banking and Mortgage Automation Is an Architectural Choice

When automation hits its limits, adding specialized tools feels expedient. Over time, it creates fragile ecosystems where $2,800 per-file exception costs compound, opaque failures trigger $185 million settlements, and 90% of analyst effort is wasted on false positives.

The alternative is architectural, not incremental: replacing tool proliferation with unified adaptive systems. Organizations making this shift have reported up to 360,000 hours saved annually, 3 billion interactions handled, and 20% efficiency gains.

AppsTek enterprise AI offerings helps financial institutions, including banking and mortgage, move beyond tool sprawl through AI-led architectural transformation. By unifying fragmented automation with contextual intelligence, continuous learning, and explainable decisioning, systems become simpler, stronger, and compliant by design.

Start the shift from tool proliferation to a scalable, future-ready architecture, connect with AppsTek Corp.

About The Author

Myrlysa I. H. Kharkongor is Senior Content Marketer at AppsTek Corp, driving content strategy for the company’s digital engineering services to enhance brand presence and credibility. With experience in media, publishing, and technology, she applies a structured, insight-driven approach to storytelling. She distills AppsTek’s cloud, data, AI, and application capabilities into clear, accessible communications that support positioning and grow the brand’s digital footprint.